Medicare Open Enrollment: Do You Need Final Expense Insurance?

Updated on Jan 20, 2025 • 4 min read

Medicare Open Enrollment for 2024 is upon us. What does this mean for you? Below, Final Expense Insurance reviews Medicare and the gaps it has when it comes to covering end-of-life expenses. Fret not, as we have selected the best options to help you cover your final expenses while on Medicare.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

Medicare Open Enrollment 2024: What is Medicare?

Medicare is a federal health insurance program for citizens 65 and older and people with disabilities. Medicare consists of parts that cover different types of medical costs consisting of hospital insurance (Medicare Part A), medical insurance (Medicare Part B), and prescription drug coverage (Medicare Part D).

There are two main ways in which you can get your Medicare Coverage. Original Medicare includes Medicare Parts A and B and you pay for the services as you get them. You pay a deductible at the beginning of each year and pay a percentage of the cost of coinsurance. Insurance for prescription drugs is separate from original medicare but can be added on.

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare. These plans typically bundle Medicare Parts A, B, and D and may have additional benefits in coverage. Medicare Advantage has yearly contracts with Medicare and follows Medicare’s rules.

Medicare Open Enrollment 2025 is ongoing now and runs through December 7th, 2024. This is a time when beneficiaries can review their coverage options and change them during the open enrollment period. The government expanded access to Medicare health insurance and lowered health care costs. This means people will see lower premiums for Medicare Advantage and Medicare Part D in 2024.

According to the U.S Department of Health and Services, the projected average premium cost for 2023 Medicare Advantage plans was on a decline of nearly 8% from 2022. To help with Medicare costs, low-income seniors and adults with disabilities can qualify for financial assistance through the Medicare Savings Programs (MSPs). The MSPs help millions of Americans access affordable health care, help pay Medicare premiums, and can also pay for Medicare deductibles and co-pays.

What Is Medicare’s Role In End Of Life Care?

The Kaiser Family Foundation (KFF) has done extensive research on national health issues in the U.S, especially on Medicare. Roughly 8 out of 10 people who died in the US in 2014 were people on Medicare. 2016 was when Medicare began covering advance care planning, which is the end-of-life care a patient will receive. This does not include, however, a Medicare death benefit.

Advance care planning involves many steps designed to help people learn about options that are available for end-of-life care. It also assists with identifying what types of care best fit their needs and share those needs and interests with physicians, family members, and friends. Advance care planning is billed separately on Medicare and beneficiaries will not have cost-sharing liability for any advance care provided with their annual medical visits.

End of Life care is defined as health care that is provided to someone days, months, or years before their death. Medicare covers this set of health care services to beneficiaries up until the point of death, notably excluding any type of Medicare death benefit. This includes services like hospital stays, home health care, diagnostic testing, and prescription drugs.

Medicare beneficiaries who are terminally ill are eligible for Medicare hospice benefits. These benefits include nursing care, counseling, and medications. In order to qualify, your doctor must confirm if the patient is expected to die within a six-month time period. Should the patient live longer than that time period, Medicare will continue to cover hospice services after a doctor has recertified their eligibility.

How Can Final Expense Insurance Supplement Medicare?

Burial Insurance, also known as funeral insurance or final expense insurance, is a type of life insurance that helps people with their post-life expenses. Typically, burial insurance is used to help with funeral costs. Burial insurance covers funeral costs like your headstone, casket, and cremation services.

Additionally, services like your wake, the funeral home, and funeral decorations are also covered. The average funeral can cost you and your family anywhere from $7,000 – $10,000 depending on where you live. That can be a daunting expense for your loved ones that are already stricken with grief that burial insurance can help to alleviate.

Seniors and folks with disabilities going through the Medicare Open Enrollment 2024process will realize that there is no Medicare death benefit. This means that should you pass while on Medicare, your loved ones will not be able to pay for your final expenses. Your loved ones may not have the thousands of dollars that it would take to cover all of your final expenses, leaving them financially distressed during an already emotionally difficult time.

While Medicare will cover medical bills related to end-of-life care, it will not cover all of the final expenses that burial insurance is guaranteed to cover. Debts such as mortgage loans, credit card bills, and other non-medical related expenses will not be covered under Medicare but can be covered with a burial insurance policy.

So now you’re probably wondering, “How do I qualify for burial insurance?” The process is actually simple depending on your age, and you can qualify within days. Most plans are easy to qualify for with no medical exam required. Premiums are designed to be affordable while still providing a significant death benefit that will help cover all final expenses after you are gone.

If you are between the ages of 50-60 and in relatively good health then you can find even more affordable options with a medical exam. Your premium rates will be low, allowing you to accumulate cash value over time depending on your policy.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

Best Final Expense Insurance Companies to Supplement Medicare Death Benefit

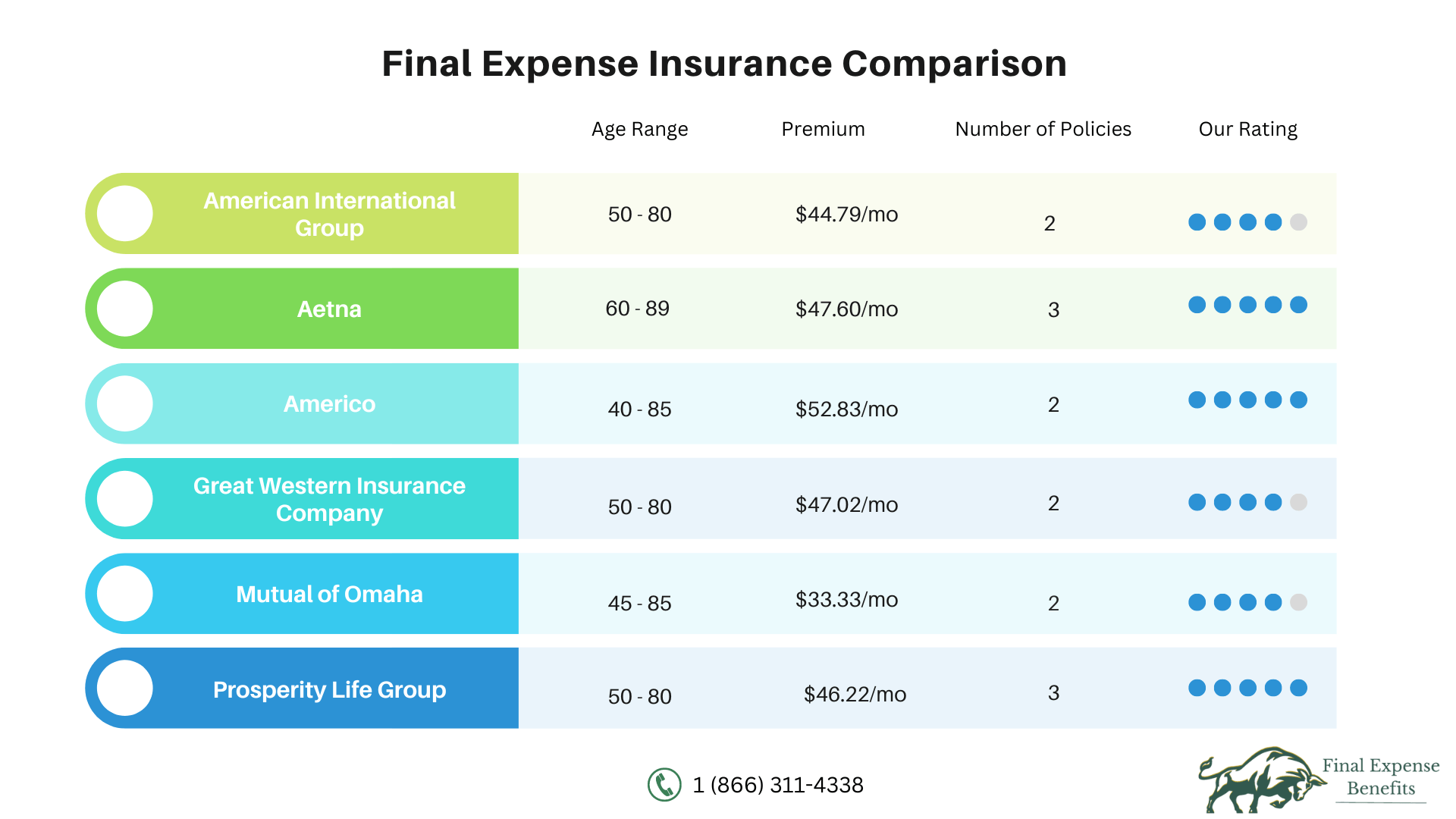

If you are a Medicare beneficiary, you may realize you need final expense insurance to cover the missing Medicare death benefits. Finding great coverage is easier than ever at Final Expense Benefits.

We partner with only the highest-rated life insurance carriers. Here are a few that can help you while you navigate Medicare Open Enrollment for 2024.

American International Group

If you are looking for something to cover the lacking Medicare death benefits, American International Group (AIG) has got you covered. AIG Final Expense Insurance is a guaranteed acceptance whole life insurance policy designed to cover all of your final expenses. Their whole life insurance is permanent, so it never expires, and there are no required medical exams. Your premiums are guaranteed to stay the same regardless of changes to your age and health. They offer flexible payment methods that accept credit or debit cards, EFT bank cards, or direct express cards.

AIG funeral insurance does have a 2-year waiting period, so it is best to act quickly if you are considering working with this carrier. Coverage options with AIG are incredibly expansive with same day-acceptance. AIG is an excellent option as it is one of our highest-rated guaranteed acceptance carriers and is best for seniors between the ages of 50-80.

Aetna

As a substitute for Medicare death benefits, Aetna provides a level, graded, and modified death benefit plans. A simple health questionnaire will determine what level of coverage you are eligible for but these also vary by state.

Level insurance plans provide full death benefits immediately and are issued to ages 60-89 years. Be mindful though, that maximum rate benefits go down as you age but the minimum benefit for all ages is $3,000.

Graded final expense benefit plans are policies with a waiting period. If you pass from an accidental death you are entitled to your full death benefits. However, if you pass due to non-accidental reasons, you won’t get your full benefit. If you pass within the first year, you are entitled to 40% of your benefit amount and 75% during your second policy year. You will get your full benefit amount in the third year of holding your policy.

A Modified Benefit Plan also allows you to access your full benefit if there is an accidental death. Unlike the graded benefit plan, the modified plan pays out an ROP or Return of Premium amount plus 10% within the first two years. You are entitled to your full benefit in the third year.

Americo

Americo provides final expense insurance that requires no physical exam for acceptance and your policy is active so long as you continue your payments on your premiums. With Americo, you benefit from protection from the very first day your policy goes into effect. With Americo’s Eagle Premier policy, you are entitled to your full death benefit right away. It is an excellent way to cover the gaps from the lack of a Medicare death benefit. Americo Insurance policies build cash value every year after it has been in force for a certain period of time. This is your money that you can watch grow your use towards other expenses.

Don’t qualify for Eagle Premier? Not to worry, the Eagle Guaranteed policy is available to you with a death benefit that is graded for the first three policy years. There are a number of riders that are available for your insurance policy. With Eagle Premier, both the Accelerated Benefit Payment Rider and the Accidental Death Benefit are included at no additional cost to you.

The Accelerated Benefit Payment Rider provides you with an advance of up to 50% of the death benefit under your current policy. This is provided if you are diagnosed with a qualified terminal illness that results in a life expectancy of fewer than 12 months (or less than 24 months in some states).

The Accidental Death Benefit Rider gives you a benefit equal to the amount of the base death benefit should you pass as a result of accidental bodily harm done to you within 90 days of an accident. It will also provide double the base death benefit in the event that you pass as a result of an accidental injury while riding as a fare-paying passenger, a great way to make up for the lack of Medicare death benefit. This could be if you are taking the public bus or riding a train. For folks who are under the Eagle Guaranteed Policy, you also get a version of the Accident Death Benefit. Similar to the Eagle Premier’s Accidental Death benefit rider, you are entitled to your full death benefits should you pass as a result of an accident (or within 90 days after an accident). Both the Eagle Premier and the Eagle Guaranteed policy can include the Child and Grandchild Term Rider. This will provide insurance for an insured child up to age 25.

If you smoke cigarettes, you can still enjoy affordable rates with Americo. Thinking of quitting? Americo insurance’s Quit Smoking Advantage allows you to pay nonsmoker rates for the first three years of the policy. Your death benefit premium will stay level so long as you provide satisfactory evidence that you quit smoking for 12 months on your third anniversary. All of these options are a great way to fill the gaps in the Medicare death benefit lapse.

Great Western Insurance Company

Great Western Insurance Company (GWIC) has three plans to choose from that can cover your final expenses from the missing Medicare death benefit. The better your health, the better your coverage rates. The Great Assurance Plan covers you from day one with immediate benefits. It is available to folks between the ages of 50-80 and who are in good health. This plan has two available riders, the Accelerated death benefit which is included at no extra cost, and the Accidental Death benefit which is an optional addition.

The Graded Benefit Plan provides for folks who are between the ages of 50-80 and have health conditions. The graded befit increases annually and pays out a death benefit according to how long you have had this policy. Should you pass in an accident within the first two graded years, then you are entitled to full death benefits.

Lastly, GWIC’s Guaranteed Assurance plan requires no health screening. This plan is available to you regardless of your health if you are between the ages of 40-80. This policy allows you to receive up to $25,000 in financial protection under this policy.

Mutual of Omaha

Is Mutual of Omaha a good Medicare supplement? Of course, when you consider their final expense insurance can make up for the lack of Medicare death benefits. Mutual of Omaha provides whole life insurance appropriately named Living Promise. All it takes is a quick 20-minute telephone interview to complete the application. The Living Promise policy has a Level Benefit Plan and a Graded Benefit Plan.

The Level Benefit Plan is available to anyone between the ages of 45-85 giving it a broaden age availability range than most other plans. You are also entitled to 100% of your death benefit should you pass at any time during your policy, making it an excellent addition regarding the lack of Medicare death benefits. Additionally, you get the Accelerated Death Benefit for Terminal Illness aka the Nursing Home Confinement Rider. This rider allows you to receive this benefit if you have been diagnosed with a terminal illness that will result in death in less than 12 months. You can also qualify for this rider if you are confined to a nursing home for more than 90 consecutive days and are expected to remain under nursing home care. The Level Benefit Plan also has the optional Accidental Death Benefit Rider. This would provide death benefits should the policyholder pass as a result of an accident.

The Graded Benefit Plan, like most graded plans, provides a laddered approach to death benefits. The Graded Benefit Plan is available to folks between the ages of 45-80. Should you pass for natural reasons within the two years of your graded plan, you are entitled to 10% plus all premiums paid during that time. It increases to your full benefit amount after those two years. However, you are entitled to your full death benefits should you pass as a result of bodily harm done in an accident.

Prosperity Life Group

Prosperity Life Group provides three possible final expense whole life insurance plans to cover the missing Medicare death benefit. These are the Level Plan, Golden Promise, and New Vista Plan; all are available through their easy application process with no medical exam required. All three plans will have premiums that will not change throughout the life of the policy and payments end at age 121. Coverage amounts range from $1,500 – $35,000 and all three plans are eligible for the Accelerated Death Benefit. This built-in feature pays up to half (50%) of your death benefit amount if you pass due to a terminal illness.

The Level Plan provides day-one coverage of the full policy death benefit. It is available to people between the ages of 50-80. This plan builds cash value for you to use.

The Graded Plan or the Golden Promise Plan is available to seniors between the ages of 50-75. This plan gives you up to 30% of your death benefit within the first year and up to 70% during the second year. After the second year under the Golden Promise Plan, you are eligible to receive your full death benefit.

The Modified Plan, New Vista, is available to folks between the ages of 50-80 and works differently from the previously stated plans. New Vista works by providing a death benefit coverage that is equal to 110% of the annual premium (excluding the policy fee). This increases to 231% of the annual premium in the second year. After that, you would be entitled to the face amount of your policy.

These figures were obtained from the NFDA and are estimates only. For a detailed quote, please contact an agent.

Is Life Insurance an Option During Medicare Open Enrollment 2024?

As stated above, Medicare is a federal health insurance program that covers hospital and medical costs. Medicare is strictly used for health insurance so the short answer to the question, “Does Medicare have life insurance?”, is no. Thinking medicare life insurance coverage is possible is a common mistake since the Social Security Administration manages Medicare. Medicare death benefits would be a much-needed addition to the program since so many people are enrolled.

While Medicare life insurance may not exist, there are a number of ways a life insurance policy can make up for the Medicare death benefit deficit. Life insurance policies offer extra financial security to cover any outstanding debts and final expenses. The lack of Medicare life insurance within its plans means you will have to look for a life insurance policy to cover skilled nursing homes and long-term custodial care. If you are looking to make up for the lack of Medicare death benefits and life insurance, then getting a life insurance policy as a supplement would be the wisest choice.

Conclusion

At Final Expense Benefits, we believe in providing you with a variety of options that fit, especially if you need a supplement for the missing Medicare death benefit. If you have questions regarding anything insurance throughout the Medicare Open Enrollment 2024, give one of our talented agents a call at (866) 786-0725 to learn more about your options today.