Social Security Death Benefits: Is It Enough To Cover Your Funeral?

Updated on Jan 20, 2025 • 4 min read

The loss of a loved one is a tough time for anyone. On top of all the emotional weight, major expenses like funeral bills may be looming.

Thankfully, there are a few ways to help with large up-front costs like funerals. The Social Security Administration offers a death benefit to assist with funeral costs. Unfortunately, the payout is not particularly significant and likely won’t be as useful as you hoped.

Check out below to learn more about the Social Security Death Benefit payout, or call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. EST, to review options that can cover your funeral expenses. Be sure to check out our free online quoting tool for quotes on life insurance plans that could cover your funeral costs.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

How Much Does Social Security Pay For Funeral Expenses?

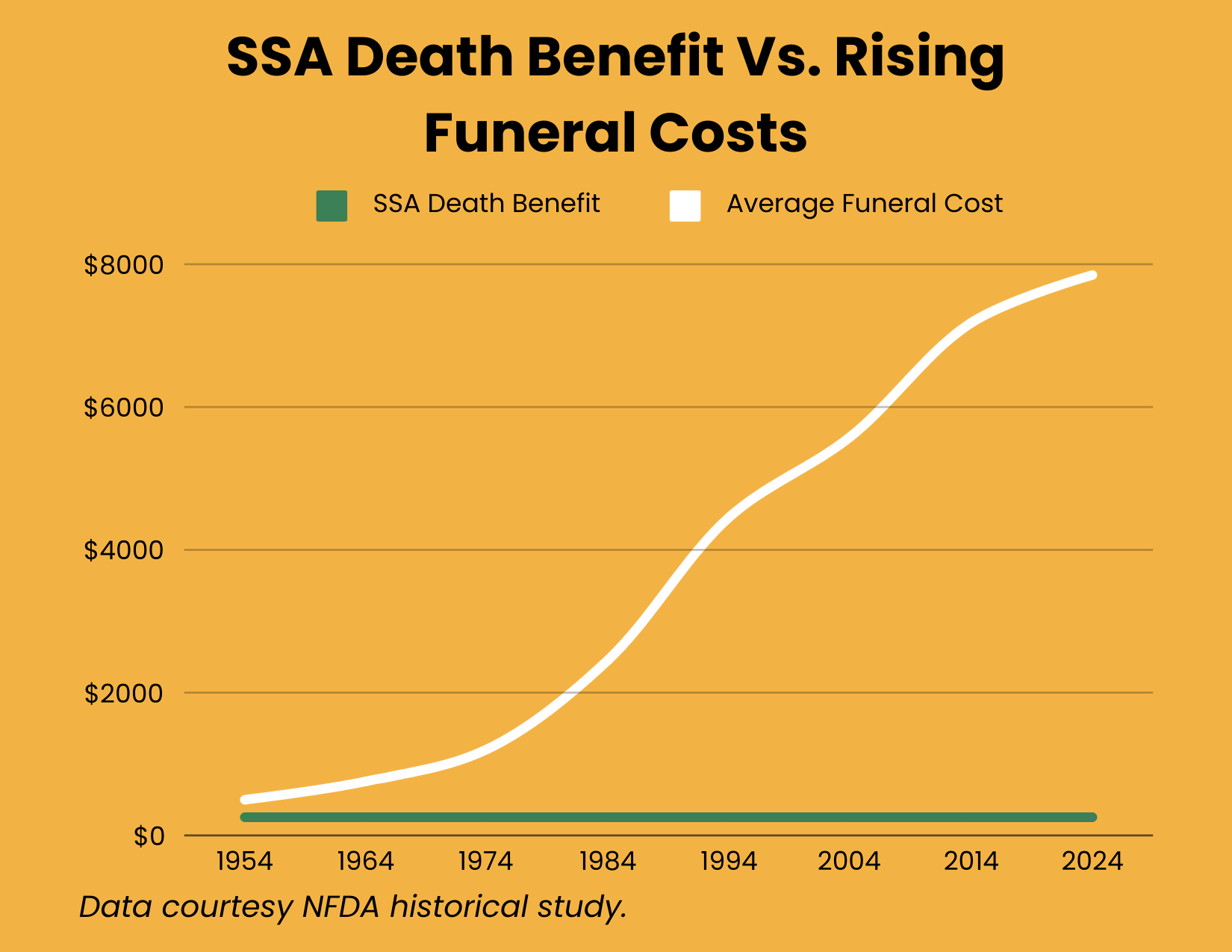

Introduced in 1935, the Social Security Death Benefit was originally intended to help surviving family members with major expenses like funerals after a loved one’s death. In 1954, the benefit total was capped at $255, which was three months of Social Security monthly payouts.

Unfortunately, this cap has not been raised, despite economic inflation since its installment. While $255 may have once covered a sizable portion of final expenses like funerals, nowadays you’d be lucky to buy a nice bouquet or a basic urn.

Who Is Eligible To Receive The Social Security Death Benefit?

Per the Social Security Administration, spouses of deceased eligible workers are the primary recipients of the $255 death benefit. The deceased worker is eligible if they worked and paid into Social Security through taxes.

Spouses are eligible for the lump-sum death benefit payment if they live with the deceased or are eligible for the deceased worker’s Social Security benefits, even if they don’t live together. Ex-spouses can also receive the death benefit payout. If there’s no surviving spouse, a child of the deceased could also receive the Social Security death benefit payout.

How Much Does A Funeral Cost?

According to the National Funeral Directors Association, the median funeral cost in the United States is $7,848. That’s averaged over costs for traditional funerals with fairly basic services and equipment. If you want a full traditional funeral with a viewing, a quality casket, a serene cemetery plot, and even a basic tombstone, costs can easily rise well past $10,000.

Even cremations average out to to costs past $6,000. This doesn’t even consider the state where you’re being buried; prices vary between states based on local laws, cemetery space, and other factors. Worse still, funerals are usually billed as an up-front cost due to the services provided. Unfortunately, providing $255, the SSA death benefit won’t cover much of your funeral expenses.

What Can Social Security Death Benefits Be Used For?

The intended use for the lump-sum SSA death benefit is, of course, covering funeral costs, but clearly, it doesn’t cover a fairly significant portion of your funeral costs. In its current state, the Social Security funeral benefit unfortunately may only be useful for paying for casket bearers or a decent-quality urn and not much else.

Thankfully, the payout isn’t tied specifically to use for funerals. It may not be much help for major up-front costs like a funeral, but at least the SSA death benefit could help pay a monthly bill or other final expenses.

How To Apply For The Social Security Death Benefit

If you’re interested in applying for the Social Security death benefit, you’ll need to fill in the SSA -8 form for the Social Security Administration, which you can do over the phone or at a local Social Security office.

Before contacting the SSA, be prepared to provide your relevant documents:

- Proof of birth, such as an original birth certificate

- Proof of citizenship, such as a valid passport or driver’s license card

- Pre-1968 military discharge papers (skip this if the discharge occurred past 1968), if applicable

- Any current W-2 forms, if applicable

- A verified copy of the death certificate

What Are Other Options For Covering Funeral Costs?

Unfortunately, while the Social Security Administration does help with paying for funeral expenses, the single lump-sum option isn’t nearly enough. Thankfully, a few other options for funeral payment assistance are available.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

Life / Burial Insurance

One of the best low-maintenance ways to ensure your loved ones aren’t in a tough financial situation with huge funeral bills is by arranging a quality life insurance policy. Most quotes for life insurance policies start at $10,000 specifically because funeral experts advise having that much money set aside for a funeral.

Burial Insurance is a specific type of whole life insurance intended to cover funeral expenses. These policies, also known as final expense insurance, have very relaxed application requirements and often provide a smaller, tax-free payout. This means you could be approved for a policy even if you have a major preexisting medical condition.

Many life insurance policies will have a mandatory 2-year waiting period, meaning payouts could be reduced or delayed if the policyholder dies within the first two years of the policy. No-wait burial insurance is also an option, but tends to have reduced payout options and higher monthly premium rates.

Life insurance is one of the best ways to provide extra funds for your family to cover your final expenses, but the amount of customization and specific options can be overwhelming. This is why it’s important to find a trusted brokerage like Final Expense Benefits. Our agents have extensive knowledge of life insurance and operate with the most trusted insurance providers. We’re ready to help you find the best policy for you and your family.

State Funeral Payment Benefits

Over 20 states offer some form of funeral payment assistance, though most programs are based on financial need. Some counties also provide support, even in states that lack a state-wide funeral payment program.

Some states, such as Illinois, offer over $1,000 for funeral assistance, so you or your family could get a decent portion of funeral or cremation expenses covered with state benefits. Be sure to look up local funeral benefit programs.

Social Security Survivors Benefits Income

Social Security Survivors Benefits can be another good way to contribute towards funeral costs. Per the SSA, you may be eligible if you’re the spouse, ex-spouse, child, or dependent parent of someone who worked and paid Social Security taxes before they died.

According to the SSA, nearly 73 million Americans benefit from Social Security or Supplemental Security Income (SSI). Survivor benefits pay a monthly average of $1,509, a significant sum when paying monthly bills and associated lifestyle expenses.

In the long term, your beneficiaries could receive a significant SSA payout, but many funerals will have up-front expenses. Reliable monthly income is great, but without a good source of lump sum money, your family might have a tough time covering major up-front bills like a funeral.

Conclusion

With average funeral costs nearing $10,000 and rising year after year, the $255 Social Security Death Benefit won’t make much of a dent in your final expenses. That’s why it’s important to understand your options and decide if life insurance could be a good choice for your unique situation.

Contact our expert agents at Final Expense Benefits to understand more about the role that life insurance fills in covering your funeral costs, and take control of an uncertain time. Call us at (855) 968-5736 Monday through Friday, 9 a.m. to 5 p.m. ET, to review options that can cover your funeral expenses. Check out our free online quoting tool for quotes for final expense insurance plans.