Does social security pay anything towards funeral expenses?

Easy Navigation

Does Social Security Pay for Funeral Expenses?

The Social Security Administration (SSA) provides a small stipend to qualifying beneficiaries’ survivors to assist with funeral expenses. For SSI recipients, this sum was established by legislation at $255 in 2020. The heirs of a deceased beneficiary have some control over how the benefit is paid out and what it might be used for. This stipend is usually referred to as a “Lump Sum Death Payment”.

Now, as you might assume, this is not going to cover funeral expenses, not even 2% of the total cost, as the average funeral cost in 2022 is $7,360, depending on the region you live in. As a result, SSA is not going to pay for your funeral expenses in 99% of cases, unless supplementary assistance is used. Read on for some examples regarding supplementary assistance, and what you can do to produce the most stress-free funeral possible.

Who Is Eligible to Receive an SSI Death Benefit?

Beneficiaries’ surviving spouses are first in line to receive an SSI death benefit. If the married couple lived together, the money is usually disbursed within a few weeks with no additional issues. Benefits may still be paid without delay if the couple lived apart, such as if the dead beneficiary was in a nursing institution. If the couple is separated or divorcing, money may still be paid, but the SSA may require additional verification before approving payment.

If the beneficiary does not have a qualified spouse, the SSA may pay the benefit to any child of the beneficiary who meets the SSA’s requirements. Generally, this means the child of the beneficiary must have been eligible for survivors’ benefits through the beneficiary during the month when the death occurred.

What Can Social Security Funeral Benefits Be Used For?

Though the survivor funeral award is intended to help with funeral costs, it comes in the form of a single cash payment that can be spent on anything the assignee wants. The grant’s real worth was close to $2,500 in 1935 when originally introduced, whereas in 2022 the amount has not kept up with increasing inflation whatsoever.

As a result, it was able to cover the costs of practically all working-class Americans’ funerals. The Social Security Administration continues to pay out the original amount, without any adjustments, after nearly nine decades of inflation, in what has become an anachronism that rarely pays the full cost of burial expenditures.

Many states, fortunately, provide additional assistance with funeral and burial costs. For example, the state of Illinois provides a one-time reimbursement of up to $1,103 for a low-income resident’s burial. Similar initiatives exist in other states, as well as in certain cities and counties. Aside from these advantages, practically every state allows for the free donation of bodies to medical research. These gifts are treated with care and analyzed for the progress of knowledge before being cremated at no cost.

How to Apply for Social Security Death Benefits?

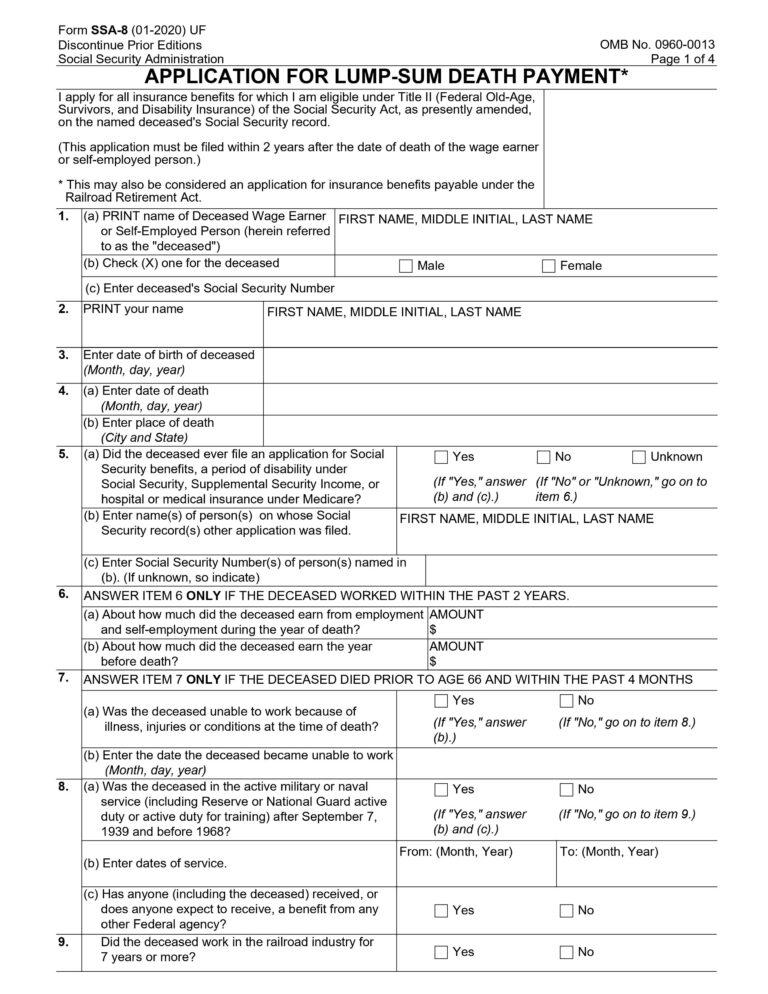

If you need to apply for the Social Security funeral benefit, you must fill out form SSA-8, from the Social Security Administration. This form is available from your local Social Security Administration office. You can also fill out the form by phone at (800) 772-1213. Before getting in touch with the SSA, be prepared to present these documents:

- Proof of birth, such as an original birth certificate

- Proof of citizenship

- Pre-1968 military discharge papers (skip this if the discharge occurred after 1968)

- Any current W-2 forms

- A verified copy of the death certificate

As the claimant, you may also have to answer a few questions to establish your own eligibility to claim the benefit. Be prepared to provide your name, address, relationship to the deceased and other information, such as your Social Security number. Remember that, if you are the next of kin of a Social Security beneficiary who has passed, you must not cash their last pension check, but return it in full to the SSA.

How Much Are Funeral Expense on Average?

Funeral and burial costs vary widely, but they tend to cost upward of $10,000.

Depending on your final wishes, the costs can be higher or lower. For example, choosing cremation over burial since the cost of caskets is one of the highest expenses when it comes to a proper funeral. Below, you can use our funeral cost calculator to determine what a funeral in your state might cost you and your family.

Total 0

These figures were obtained from the NFDA and are estimates only. For a detailed quote, please contact an agent.

What are My Other Options to Pay for my Funeral?

Medigap

Medigap is essentially supplemental assistance meant to fill any gaps left by the original SSA death benefit, which end up being quite large gaps considering funeral costs in 2022. Sometimes also called SSI Life insurance, this supplemental assistance is offered by private organizations and exists like a whole life insurance policy, wherein you’re guaranteed payout at the time of death benefit, and can be renewed/closed at any time. The two are usually paid out at similar time frames.

Final Expense Insurance

Final Expense Insurance is always a great option, as it can peacefully coexist with any other whole life insurance policy, as well as aiding in beneficiaries in the case of untimely circumstances. Final Expense Insurance is coverage meant to mitigate funeral expenses, and usually maxes out at $50,000 in coverage, although not always. Even though Final Expense Insurance is marketed towards funeral expenses, the actual payout amount may be used at the discretion of the beneficiary.

Social Security Survivors’ Benefit

Survivors’ benefits are recurring monthly payments that exist on top of the $255 given to individuals who meet lump sum death benefit criteria. These survivor benefits’ financial value differs depending on conditions applicable to the beneficiary. Certain factors that may adjust your rate include if a spouse has survived whereas their partner has not, a surviving spouse must now care for a minor, or children with disabilities, and more. These funds are not treated as assets for tax purposes, and there is no restriction on how this money may be used.

The recommended and lowest cost option to ensure your final wishes and legacy are honored appropriately is purchasing a Final Expense Insurance, unless applicable for SSA Life Insurance survivor benefits.

Do SSI and Life Insurance Contradict Each Other?

As Medigap is controlled by a private organization and does not contain cash value until payout, your SSA and Life Insurance eligibility are unaffected by existing coverage. Although Medicare’s A + B plans are in fact deducted from SSA and Life Insurance amounts, Medigap is considered plan D and therefore non-applicable.

Conclusion

In conclusion, SSA lump sum’s benefit is lackluster at best, but thankfully there’s many options available to those who are prepared, like SSI Life Insurance. As covered in this article, many options are either low-cost, or free depending on application status. We are happy to help guide you based on your individual needs.

If you have any questions, feel free to give us a call at 1-866-311-4338.