Life Insurance For Obese People

Updated on Jan 16, 2025 • 4 min read

If you consider yourself overweight or are concerned an insurance provider will, then we’re here to say that being overweight doesn’t actually impact your ability to qualify for life insurance all that much.

It’s actually much easier than one may think to qualify for life insurance as an overweight individual, and only certain specific instances will flat-out disqualify you from coverage. Read on for a detailed analysis and tips to follow if you consider yourself overweight.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

What Is Considered Life Insurance For Overweight People?

Millions of Americans are diagnosed as overweight or obese each year. These figures are based on the Body Mass Index, or BMI, which is a chart that calculates your weight and height and assigns you a number. A BMI of 19 to 24 is regarded normal, 25 to 29 is considered overweight, and 30 is considered obese.

As an example, If you are 6’2″ tall, you should weigh between 150 and 190 pounds to maintain a healthy BMI. If your BMI is greater than 30, your weight of 234 pounds qualifies you as obese.

Can I Get Life Insurance For Obese People?

Most obese people can get life insurance for obese people, but they must apply with the correct insurance company. Life Insurance for Obese candidates is catered to by a small number of top-rated life insurance companies. The options you have and the cost of your coverage will be influenced by your overall health, age, gender, and lifestyle.

Aetna (CVS Health) is our top choice for Life Insurance for overweight or obese people, especially those over the age of 60. Among all of the top-rated life insurance companies in the United States, their underwriting guidelines offer the most flexibility as they do not have a height/weight chart.

The only time an obese individual may be flat out denied coverage involves any accompanying conditions that may pair with the weight, or if you’re so obese that you can no longer care for yourself. This is the case regardless of your circumstances – if the risk to insure you is too high you will not be insured.

What Underwriting Can I Expect On My Application?

Generally, Life Insurance for overweight people poses no issues to the insurance company themselves, rather, it may lead to other health issues such as diabetes, high blood pressure, and other various ailments that tend to correlate to weight. The way insurers will do this usually lends itself to a “build chart”, or something similar to a BMI indicator.

With this chart, they’ll lay out various heights and weights, disqualifying you if you go over the maximum weight (which happens to be very high, 246 lbs for a 4’10 individual for example). Some insurance companies do not even refer to this chart whatsoever, nor do they have any weight restrictions – it really depends on who you’re dealing with.

Depending on your weight, it could change your underwriting class or even disqualify you in extreme cases. As mentioned previously, this will depend on a combination of factors including whether or not you have medical conditions caused by weight such as diabetes, high blood pressure, high cholesterol and heart disease.

It’s also important to note that your weight will never be asked for individually, rather, you will be asked your height and weight as they are analyzed in proportion to each other. You also don’t need to worry if you’re taking weight loss/other various prescription drugs that may correlate to obesity, as this will never be an issue.

Again, it matters more so what the accompanying conditions you may acquire as a result of the excessive weight rather than the weight itself.

All life insurance will pay in the case of death by natural causes. This is the typical use case for any type of life insurance. And nearly every life insurance policy will pay the benefit if the insured dies in an accident.

While examples of what life insurance payouts can cover are listed below, beneficiaries can use payouts for any purpose. Payouts are typically intended to cover costs for a funeral or other end-of-life expenses, but the recipient can use the cash from the lump sum for any desired purpose.

The right life insurance policy can be a versatile tool in providing financial security for your family. Learn more about each type of life insurance and what they can be used to cover below.

How Weight Affects Your Rate

Insurance companies and their underwriting usually contains a hierarchy where they place you based on the information provided to them. These classifications are determined based on your relative risk to the insurance company and will provide you with more inexpensive monthly premiums the higher you are on the list.

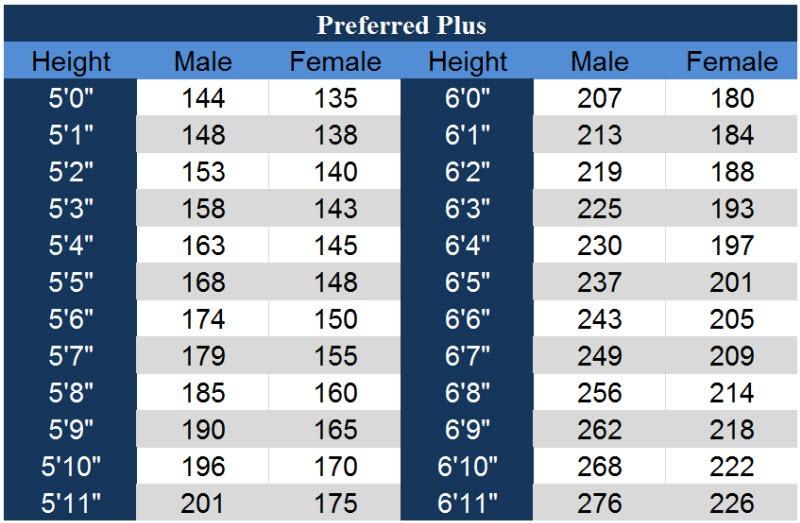

Preferred Plus: This is the most exceptional rating an individual can receive when being graded for coverage. If you’re in the Life Insurance for Overweight People by just a few pounds over the ideal weight given by the insurance company, you will not receive this rating.

Preferred: The second best rating an individual can receive. This category is reserved for those who may have had minor health issues, or may have pre-existing conditions present within their family but are otherwise in great health.

Standard Plus: The next best category, standard plus is reserved for those who are in good health but may have or have had an applicable condition in the past, or within their family.

Standard: This category is reserved for those in average health. Those in this category may have conditions associated with them but are still manageable, like blood pressure.

Table Ratings: This is reserved for those who pose a high risk to the insurance company. To get into this category, you must pose a severe risk to the company.

Final Expense and other Life Insurance For Overweight Individuals

Final Expense Insurance is an underrated option for those who fear underwriting or may be deemed as too Life Insurance For Obese People or unfit to care for themselves.

Final Expense Insurance exists as a guaranteed whole life insurance option meant to provide coverage to those without a medical exam or *sometimes* a questionnaire. As a result, you will be applicable for coverage although your rate may be adjusted depending on a few factors.

A group life insurance policy may also provide some relief to those struggling to qualify for the desired type of insurance they would like. A group life insurance policy is usually offered through an employer, and as a result of the large group, will not be grading the individuals but rather the group as a whole.

The downside to this policy type is that it terminates if you leave your employer, on top of the fact that the rate offered to you may not be as lucrative as an individual policy.

Can I Get A Lower Rate If I Lose Weight?

Absolutely, although not immediately in some cases. This process of re-evaluating your qualifications is called “reconsideration” and may be requested at your discretion. In most cases, 12 months is the period of time given to those that need to lose weight, or have lost weight and need to keep it off. At this point, you will be asked to take another medical exam or fill out another questionnaire.

This also may be reversed. If insurers find new risks associated with you during the process, they may raise your rate or flat-out disqualify you. The only exception to this process involves fixed premiums with a whole life insurance policy wherein your rates are locked in at coverage approval.

If you’ve been denied coverage or rated as “Life Insurance For Obese” people, you can expect a few scenarios.

First of all, your qualification assessment may be postponed for 6-12 months with the stipulation that you lose a certain amount of weight and keep it gone.

Secondly, if you’ve lost weight recently and haven’t been approved yet, you may have to enter a probation period where you are expected to keep that weight down.

Finally, you may simply be offered a higher rate than someone else/the average.

Will I Pay More Because I'm under Life Insurance For Obese People?

With the right guidance, No.

It’s not uncommon in the insurance industry for someone to get the wrong agent and get put into the wrong plan with higher premiums, waiting periods often up to three years, and variable premiums.

This is why it’s so important you do your research and find the right advisor to guide you through the process. We at Final Expense Benefits partner with over 20 carriers, with:

Being some of the ones that stand out among the crowd. Reduce the stress involved with life insurance for seniors and let us do all of the heavy lifting for you.

Call our expert agents Monday through Friday, 9 A.M. – 5 P.M. ET at (866) 786-0725 or check out our free online quoting tool to receive an estimate.

Can I Lie About My Weight On The Application?

Lying on your application would only be possible if there’s no medical exam involved, and even then, an insurer may be able to verify your medical records and come to a decision that way. We do not recommend lying on your application as it’s just too easy to verify the data requested of you.

Lying on an insurance application is considered fraud and at the very least your policy will be canceled immediately if found out.

Best Options For Life Insurance For Obese People

Plenty of companies that offer life insurance cover individuals that have been diagnosed as obese.

We recommend Aetna (CVS Health) as our go-to carrier for obese individuals due to their flexible underwriting guidelines (No Height/Weight Chart, coverage offered at age 40), affordable monthly premiums and day 1 level coverage with no waiting periods.