What You Should Know About Planning for Funeral Costs

Updated on Jan 20, 2025 • 9 min read

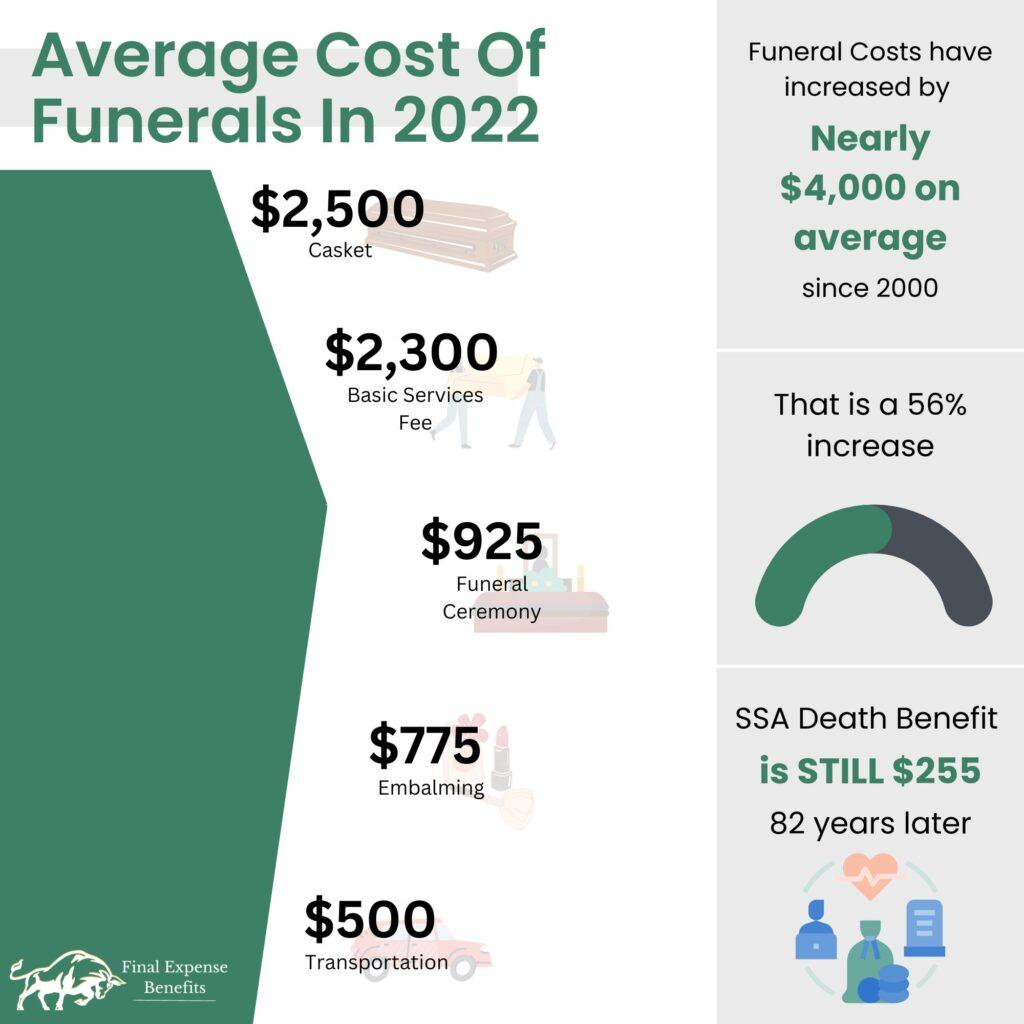

This may not surprise you, but funeral costs aren’t cheap, and that’s only getting worse as the years go by.

Since 2016, Funeral Costs have risen almost 10%, and it shows no signs of slowing down now.

Although we saw a huge spike in funeral costs with the onset of the 2020 covid-19 pandemic, this can occur at any time on top of the incremental increases each year due to inflation and other factors.

Here’s a complete breakdown of how to plan for funeral costs, when is a good age to start planning, and the options available to you.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

Thinking About Funeral Costs and Arrangements

Funeral costs have never been historically cheap, but this is only worsening as the years go by.

Thankfully, there are a lot of different programs available meant to help prepare those for the onslaught of funeral costs associated with funeral plans.

The main example one probably thinks of when it comes to preparing for funeral plans involves life insurance, and for good reason. Life insurance opts to protect your finances in the case of unforeseen circumstances for a relatively low monthly payment.

It’s important to note that life insurance significantly increases the longer you wait, as well as becoming harder to qualify for.

When applying for life insurance your health is rated and your rate is adjusted as a result of the risk factor you pose to the company if they were to insure you.

You’re given a maximum coverage amount that you select when applying for insurance, and that maximum is calculated into your monthly premium. Specifically, this means that the later you apply, the faster the insurance company is going to pace you so that you may make adequate payments on your policy before any unforeseen circumstances occur.

What Goes Into Funeral Plans?

There’s a lot of factors that go into accurately strategizing funeral plans, and these can vary wildly depending on the type of funeral plan desired.

For example, cremation is generally a cheaper alternative to a traditional burial and features a lot more customizable features then the former. Cremation can also come in many forms, featuring tree pod burials as well as donating your body to science, just to name a few.

1

Burial Caskets

Burial Caskets, or the biggest discrepancy regarding funeral planning, boasting an impressive price range beginning as cheap as $50, and maxing out at $10,000 for some of the most extravagant materials. The introductory $50 offers itself to cardboard caskets or other like-minded materials, opting to focus less on the ceremony and more on the finished product (buried at a burial plot). Towards the top of the $10,000 range, you have caskets made of precious materials such as mahogany, gold, what have you. Keep in mind the FTC funeral rule essentially forces funeral home providers to send you an itemized list of casket options if requested, as well as why they have reached the price point conclusion listed. Keep this in mind if you don’t see any cheaper options, as it’s within the best interest of the funeral home provider to omit these options.

- Burial Caskets can range from $50-$10,000 depending on the material used.

2

Embalming

Although not a mandatory process associated with a traditional burial or cremation process, embalming is commonly utilized as it solidifies the last memory of those viewing the service by making the deceased as presentable as possible.

Embalming by definition is the science of preserving and presenting human remains – this is usually done with makeup and other materials used to prevent decay in the human corpse. Keep in mind that no matter the material used, decomposition will begin eventually.

- Embalming is around $725 depending on the funeral plan / home, extent of the embalming, as well as the state you live in.

3

Funeral Planning Basic Service Fees

Not even accounting for any additional amenities or features, Funeral Homes will always include a mandatory fee associated with a viewing or the applicable services. This fee is paying for the staff utilized within the process, as well as any other fees such as rental services, gas prices for transportation, body removal and preservation, what have you.

- Generally a basic funeral home service is going to average around $2,000.

4

Burial Plot Cost And Headstone

Depending heavily on the location as well as the extravagance of the headstone, Burial plots and headstones can vary wildly in price, more so than even burial caskets. This extreme fluctuation in price is due in part to the type of cemetery, location of plot, as well as the materials used within the headstone. Public cemeteries are going to be more affordable than private ones, headstones made of stone are going to provide more affordability than marble, as well as in which state you live are all examples of factors that may serve to increase/decrease the price. Keep in mind that you’re not actually purchasing the land, you’re merely renting the space.

- Burial Plots can cost anywhere from $200 to $20,000

- Burial Headstones can cost anywhere from $1000 to $10,000

5

Cremation

- Cremation can cost between $1,050 and $7,000.

The FTC Funeral Rule

The Funeral Rule is a law mandated by the American government and enforced by the Federal Trade Commission – what this rule means is that Funeral Home providers must be transparent with funeral costs, mandating that they provide you an itemized receipt of items before purchase if requested.

There’s a few other miscellaneous factors involved with this rule, such as when selecting caskets you are entitled to a transparent list of all available casket options before making a selection, as well as a written statement before and after payment/service. The FTC also mandates that an explanation be given regarding any local cemetery or cremation choices/requirements.

Planning For Funeral Costs In Your 30-40s

This is generally when most individuals start planning for any future final expenses, usually reflecting the birth of a child or the loss of a loved one. Although this may seem too early to start entertaining funeral expenses, it’s been reported that 75% of those that planned the funeral felt a burden lifted from their spirits moving forward.

It’s important to note that pre-planning a funeral with an actual funeral organization locks in the monthly rate and maximum coverage amount throughout the remainder of the policy holder’s lifetime, so long as monthly premiums are continued to be paid on time.

Planning For Funeral Costs In Your 50-60s

Within this age range, you’re now eligible for certain programs and policies, such as final expense insurance. These policies usually are available to individuals as early as 45, up to age 80. The average age of retirement in America is also 59 years old, falling within this age range.

Generally when retiring or undergoing retirement, it’s important to gather one’s assets and other relevant information together in an organized fashion to promote the most seamless transition into retirement.

Planning For Funeral Costs Over The Age Of 70

Some avoid planning for final expenses because it’s a morbid topic, others simply procrastinate, regardless of your reasoning, it’s never too late to plan for funeral costs, and not planning for funeral costs is worse than planning for it at the last minute.

It also might not even be the “last minute” as the average age of death steadily continues to increase as the modern age continues to evolve. The bottom line is that your loved ones will thank you in the long run.

Why It's Important To Think Ahead When Funeral Planning

Regardless of how expensive funeral costs are, delaying them only serves to make the process more difficult. Costing upwards of $8,000, it’s pretty crazy to think one may have to spend $8,000 completely out of nowhere and this is why formulating a strategy is important to do as early as possible. You also have more agency over how the funeral plans will be conducted if you plan it in advance, leading to even greater peace of mind.

What Are My Options When Paying For Funeral Costs / Burial Services?

1

Pre Paid Funeral Plans

Pre-paid funeral plans are an arrangement made ahead of time with an applicable funeral service home provider, usually the plan exists in increments of $10,000 and usually cap out at $25,000. These plans mirror life insurance policies in that you make monthly payments to the provider and in return you receive a “payout” upon death, which in this case goes directly to the provider in return for a funeral service. The benefits of this plan involve the ability to plan out every minute detail of your funeral plans to your specifications, as well as locking in your funeral costs early, creating peace of mind as a result.

2

Final Expense Insurance

Final expense insurance, otherwise known as burial insurance, end of life insurance, what have you, is an insurance policy meant to mitigate funeral costs for a relatively low monthly premium. Final expense insurance begins at $2,000 in coverage and extends up to $25,000 in most cases. Final expense insurance does not contain a cash value, so it may coexist with other life insurance policies as well as supplemental assistance programs. It’s also important to note that final expense insurance does not hold any restrictions regarding what the benefit amount may be used on, lending itself to whatever is needed by beneficiaries. Final Expense insurance may be as inexpensive as 30/month.

3

Government Assistance

Government assistance associated with funeral costs includes things like, the SSA death benefit, Burial Assistance, Covid-19 funeral assistance, survivor benefits, as well as many more. It’s important to note that in most cases regarding these supplemental assistance programs, the program itself does NOT pay for 100% of the funeral costs, or even close. For example, the SSA death benefit is a $255 one time lump sum paid to any eligible surviving spouse. Burial Assistance is a program that provides up to $1,000 for burial costs and up to $650 in cremation costs for eligible members. It’s pretty apparent to see that this simply isn’t going to cut it, with funeral costs averaging out to just under $8,000 in 2022. The only one that comes close is the Covid-19 funeral assistance program, which on average provides $6,400 to those who have been affected by death as a result of the covid-19 pandemic.

4

Other Life Insurance Policies

Aside from supplemental assistance or other funeral planning related policy, there’s also traditional life insurance policies that serve a similar purpose.

Whole Life Insurance exists as a permanent life insurance policy that does not expire, nor does the price ever change so long as monthly premiums are made on time. Generally this policy exists in face amounts of $50,000 but that may also change.

Term Life Insurance exists as a policy that must be renewed when the term expires or converted into permanent coverage after the policy expires. Term life insurance is cheaper than whole life insurance in most cases, but as a result contains a few more restrictions and is harder to qualify for.

Conclusion

We know this is a lot of information being thrown at you, but it’s better to go prepared rather than the opposite.

Thankfully, here at Final Expense Benefits, we contract with only the top senior life insurance companies. If you’re a senior on a fixed income, we work with carriers like;

If you’re ever unsure moving forward, we urge you to call us with your questions. The last thing anyone wants to do is leave that financial burden for their family to handle.

FAQ

What Is The Appropriate Age To Preplan Final Arrangements?

Statistics indicate that 35 is the sweet spot when it comes to acquiring and maximizing life insurance.

What Percentage of People Pre Plan Their Funeral Costs?

It’s reported that only 24% of individuals pre plan for their funeral costs.

Is It Better To Cremate Or Bury?

In terms of affordability cremation is the better option.