The Best Final Expense Insurance for Smokers

Easy Navigation

Many Americans assume they can’t get a life insurance policy or final expense policy if they smoke or use nicotine. Like pre-existing conditions, you can still get approved for a final expense life insurance plan. You may be surprised to find out that even as a smoker, there is an option that will work for you. This article will provide you with the information you need to create the most prepared Funeral Insurance Plan, as well as rates for the average smoker.

What is Final Expense Insurance?

Generally, Funeral Insurance aims to provide beneficiaries with an additional surplus after all funeral expenses have been taken care of. The funds provided by Funeral Insurance do not contain a clause or restriction, meaning that the beneficiary may choose to spend this on anything relevant to their Funeral Insurance Plan. Keep in mind, with other whole life policies the sum administered to you holds a cash value, whereas, with Funeral Insurance, it does not. Specifically, this means that you are unable to withdraw your Funeral Insurance benefits into a monetary value before a beneficiary payout occurs. This is offset by the fact that Final Expense Insurance generates a payout quickly relative to other whole-life policies, usually able to provide the complete beneficiary payout in as little as two years, depending on the coverage amount.

How Does Smoking Effect Life Insurance?

Smokers are usually offered a higher rate of insurance due to the fact that smoking reduces life expectancy in most cases. In some cases, Funeral Expense Insurance eligibility may even be denied, depending on the severity of use, underlying conditions caused as a result, as well as life expectancy and age of the applicant.

Although final expense life insurance doesn’t need a medical exam, they are still required to assess your smoking habits, as well as the time frame in which you’ve participated in such. If you answer yes, you would then be subject to the smoker’s rate. Although one may be deterred to wait this year in an attempt at a lower rate, this isn’t always necessary, as some providers may recognize your attempt to quit and work with you from there. It’s also important to keep in mind that the later you begin the policy, the more your premiums will remain as there’s overall less time to pay towards the full amount of the policy, as determined by brokers. There’s also a plethora of options for current smokers at an acceptable rate, as seen below. Keep in mind that the rate for smokers, in extreme cases, doubles the rate of non-smokers for the same policy. There are also other factors involved, such as any pre-existing conditions, age of applicant, the overall health of applicant, family history, etc.

With final expense or any life insurance, There’s no specific amount towards that year off smoking, just one cigarette will determine you ineligible for non-smoker rates. Even if you have only smoked one cigarette, you would still be given the smoker’s rate. Thankfully, we work with top insurance carriers that specifically have experience with those that smoke, and will attempt to bridge any gaps in coverage.

How Does Life Insurance Companies Decide Who is a Smoker and a Non-Smoker?

If you’ve ever signed up for a whole life policy, or a policy that does not require a medical examination, then you may have seen some of the questions asked of you. Things like your social, doctor history/contact, family history, etc. Although you may have seen questions discerning the specific use of tobacco products like pipes, dip, etc, the Funeral Insurance Companies are the most concerned with cigarette use, as this form of smoking directly correlates to life expectancy decreases.

According to the CDC, the average decrease in life expectancy for a cigarette smoker is a decade, at minimum. As we know, there are a tremendous amount of different ways to consume tobacco products. We want you to know that Insurance Companies are the most concerned with cigarette use, and this would be the “worst” form of a smoker to them. Note that when the phrase, “smoker” is used in regards to an Insurance Company, they mean “cigarette smoker” specifically.

Although not always the case, If you use:

-Vapes

-Nicotine Patches or Chewing Tobacco (dip)

-Pipes

-Cigars

You may find yourself qualifying for a non-smoker rate, differing at the discretion of the Insurance Broker. Mainly because these forms just don’t hold the same associated risks as cigarettes.

Smoking And Other Types of Tobacco

We encourage you to compare your rates when assessing the best options for your funeral insurance plan or to give us a call at (866)-311-4338 for a free consultation regarding your options. We at Final Expense Benefits specifically have a section of carriers we align with to provide you with the most competitive rates for smokers, or those that plan to quit smoking.

People who use other tobacco products have a chance of not paying a smokers rate because they don’t pose the same health risks, although this does again depend on the severity of use, family health, etc, as mentioned above.

Best Burial Insurance Companies for Smokers

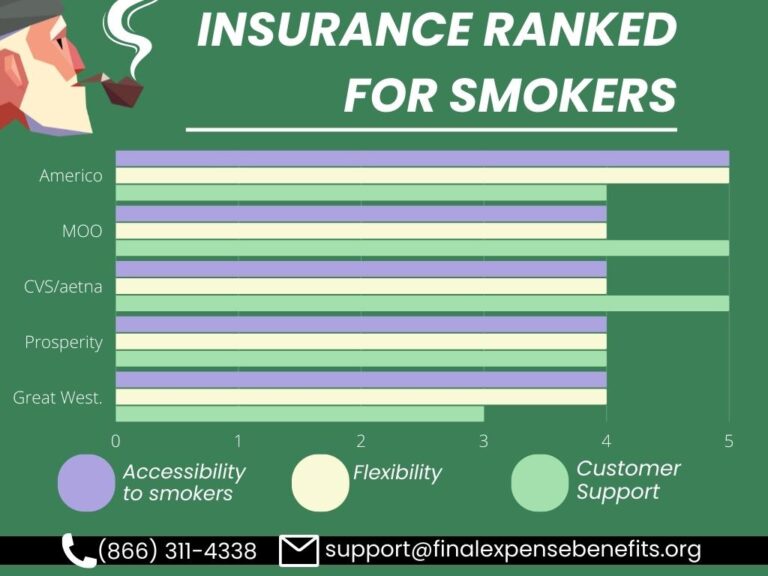

We at Final Expense Benefits have compared over 51 Top Insurance Companies across our vendors, and have concluded the best overall choice for those who smoke or plan to quit soon.

5. Great Western

Smoker’s Insurance: 4/4

Flexibility: 4/4

Customer Support: 3/5

Offering a very competitive rate for smokers, Great Western Insurance Company is a valid option for those that know they’re going to be classified as a smoker. Toting grief support, solid customer service, as well as competitive rates for Burial Insurance.

4. Prosperity

Smoker’s Insurance: 4/4

Flexibility: 4/4

Customer Support: 4/4

Similar to CVS/Aetna, Prosperity remains a stable middle ground for most people when it comes to Whole Life Insurance. You may find that often, Prosperity and CVS/Aetna have competitive rates to each other, as well as similar features. These features include their exceptional customer service, notoriously quick application process, etc.

3. CVS/Aetna

Smoker’s Insurance: 4/5

Flexibility: 4/5

Customer Support: 5/5

The best middle ground option for familiarity as well as for the benefit of the smoker. CVS/Aetna is a pioneer, providing claims to over 39 million Americans – it’s no wonder they constantly receive high marks on their ratings. CVS doesn’t particularly offer a distinguished rate for smokers vs non-smokers, but its overall great introductory price point, stability, and customer service make this a great option regardless of other circumstances.

2. Mutual of Omaho

For smokers: 4/5

Flexibility: 4/5

Customer Support: 5/5

A great option for those who smoke – the rate provided to those who smoke vs those that do not see little difference between each other. Omaha has remained a staple in the industry, providing a great middle-ground for pricing as well as internal support. Omaha has been noted for its overall superb customer service and brand stability.

1. Americo

For smokers: 5/5

Flexibility: 5/5

Customer Support: 4/5

Without a doubt your best option as a smoker. Americo advertises that they offer the same rates for tobacco users that they do to non-tobacco users, and we’re here to confirm that this is in fact true. A woman who is 60 years old, 5’4, 160 lbs, who smokes would receive the same rate as another woman of the same specifications that did not smoke. We’d also like to note that Americo contains a flexible group of clauses, in that they offer coverage to those with extreme underlying conditions, such as sickle cell anemia or moderate to severe seizures.

How To Get Final Expense Insurance for Smokers

How Can I Reduce My Life Insurance Rates as a Smoker?

The good news is, many of the top senior life insurance companies provide discounts or benefits for you to quit smoking.

The CDC says that if you quit smoking before you turn 40, it lowers the chance of dying from smoking-related disease by 90%. Once you are smoke free for a minimum of 12 months, you may qualify for non-smoking rates.

Although more at the discretion of your Funeral Insurance Company, they may also work with you more easily if you show that you are committed to quitting smoking.

Conclusion

If you’re a smoker, you need final expense life insurance just as much as a non-smoker. Thankfully, here at Final Expense Benefits, we have you covered.

Although you may pay a higher rate, this is not always the case, especially concerning brokers that advertise their willingness to work with smokers, such as Americo. We can swiftly and skillfully connect you with a life insurance provider to give your family peace of mind.

Together, we can not only help you find an affordable monthly rate but hopefully add more years to your life by giving you the information you need to discourage cigarette use. Call 1 (866)-311-4338, for a no-cost consultation, today.

Frequently Asked Questions

What happens if I lie on my application?

Let’s put it this way. Funerals are expensive, and you get that. Considering final expense coverage options aren’t expensive, you would trade a minor monthly expense to ensure your beneficiaries are secure.

What do Funeral Insurance Companies ask on my application?

Generally, things like your family history, age, weight, tobacco use, and pre-existing conditions will be assessed. There will also be questions pertaining to your social, as well as anything diagnosing you as who you say you are.

I don’t even smoke that much, do I have to tell the insurance companies this?

Unfortunately, you will need to disclose any information they request of you. As mentioned above, if you quit smoking for at least a year, or plan to do so, brokers may work with you at their discretion.

Does Covid-19 affect this process? What if I’m left with long-haul covid?

As long as the policy date is active and you have paid any applicable premiums, Covid will deem you/the beneficiary eligible. We encourage you to bring this up with your broker if long haul covid has permanently affected your lungs or other organs.

What considers you an “ex-smoker”?

Refraining from cigarettes for at least a year.