The Top 5 Reasons Final Expense Insurance is Great For Seniors

Easy Navigation

You may have heard of Final Expense Insurance for seniors, otherwise known as Burial or Funeral Insurance, and thought, “what’s that all about?”

You may know, here at Final Expense Benefits, we care a lot about Final Expense Insurance for seniors.

So today we’re here to compile a list of the 5 definitive reasons why final expense insurance for seniors is a great idea for seniors.

What Is Final Expense Insurance for seniors?

Final expense insurance for seniors is the type of insurance that’s in place to cover the funeral costs after your passing.

This is the type of coverage that you can apply for, and once you’re approved, your family may be entitled to the payout immediately, no matter how early or late your passing might be.

While final expense coverage is generally used to cover funeral/burial costs, one may use the funds in any way desired.

In this way, some brokers claim that there is essentially no difference between final expense insurance for seniors and another regular Whole Life Insurance Policy.

In a way, this is true, as either way you’re relieving any potential financial burdens regardless of your coverage.

Final expense coverage usually exists as a simplified issue plan, meaning that you are approved regardless of any previous medical conditions, 99% of the time.

The premiums are also generally low (depending on the condition of the applicant) and whole life, meaning that your rate does not change within the span of your lifetime.

Additionally, these plans can coexist with Medicaid, depending on your total assets.

If said assets are too high to qualify, one may withdraw and use these funds to purchase additional coverage or what have you, maximizing your beneficiaries’ payout.

1. It Sets You and Your Beneficiaries For An Abundant Future

Final expense insurance for seniors acts as a supplemental policy meant to increase your overall payout in the event of untimely circumstances.

Final expense insurance for seniors policies are overall cheaper than other similar policies and do not interfere with existing policies.

With the rising costs of funerals in America, it’s important to be as prepared as possible.

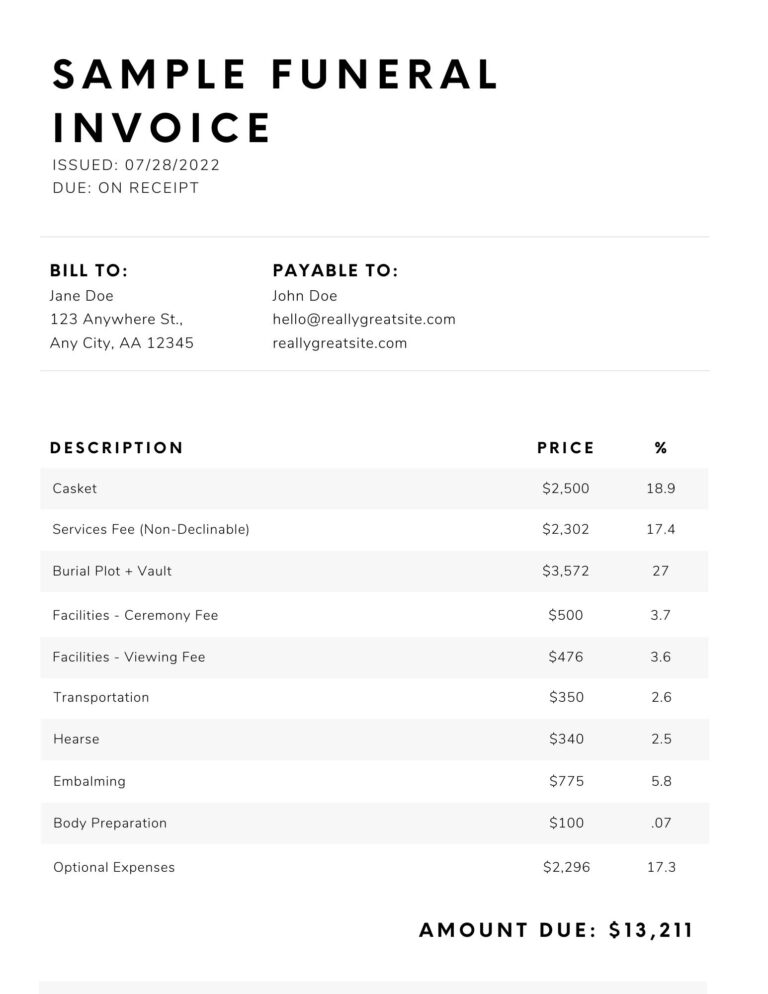

Funeral costs in 2022 on average sit around $9,000, and that’s without the potential amenities one may wish to have with their ideal service/funeral – funeral costs can reach towards the upper $13,000’s in some cases.

The Cost of A Funeral in 2024

Although it depends on the state in which you wish to host the service, the average cost of a funeral in America ranges from $8,920 to $9,429, which is not factoring in the extravagant amenities one may include in a funeral service/plot.

There’s also the Cost of cremation vs burial as well.

The cost of your funeral in 2024 heavily depends on the route you choose to utilize, with that being cremation vs burial.

Cremation is without a doubt going to be the cheapest option, although burial is more traditional and commonplace (for now).

Cremation use is quickly on the rise, doubling in overall use from 4.5% to 9% in the past 5 years.

A few of the most important factors involving a funeral are as follows:

Burial Caskets

Although specific to a traditional funeral service, Burial caskets can range greatly in price from each other, with the low end potentially costing you as little as $50, and the high end remaining towards the higher end of $3,000.

The big discrepancy in price comes from the fact that metal caskets can come in very extravagant forms, sometimes containing traces of gold/metal and embroidered with high-quality materials.

The lower-end caskets forgo these features, sometimes even existing as a cardboard casket in the case of cremation caskets.

Burial caskets tend to be much higher than cremation caskets due in part to the fact that cremation caskets are burned/vaporized in the process of cremation, whereas a traditional burial casket remains intact indefinitely wherein the remains of the deceased stay.

Funeral Home Service Fee(s)

When hosting a funeral service, the contracting location has to support your funeral in a variety of ways.

As a result, there are a few residual funeral home fees associated with the cost of burial.

This fee may include labor costs, cost of the facility, paying staff, transportation, and even embalming in some cases.

As a result of adding all of these fees together, the funeral home service fees can reach $3,000 considering all of the above are covered.

Even though it is one of the most expensive aspects of a funeral, at least you can feel secure in the fact that this facility and its team are here for you and your service in these unfortunate circumstances.

Embalming

Embalming, or the process of preserving the human body, is associated specifically with a memorial service.

Within said memorial service, especially in the case of an open casket burial, the deceased body is preserved and made to look as presentable as possible.

Within this process, a specialized team is sent to address the diseased corpse in which they use a plethora of beauty tricks and techniques to create a presentable appearance.

This is meant to serve those viewing as a fond reminder of what once was.

The cost of this process can be up to $1,000 depending on the burial service and the extent of embalming required.

Burial Plot Cost And Headstone

Depending on the state in which the cemetery is located, as well as the desired extravagance of the aforementioned burial, the price of a burial plot cost and accompanying headstone can be between $1,000-$4,000 for the plot, and up to $10,000 for the most expensive headstones.

These features and those like these are generally what drive up the cost of burial services the most as a result of the massive variation in price.

2. Relatively Low Monthly Premiums

A final expense policy is going to offer a low monthly premium relative to the cost.

For example, a $10,000 final expense policy is going to range from just $24/month to $100/month, depending on your age.

The lower the age in which you apply, the lower your monthly premium will be as you are assessed by the provider to have more time to pay said policy off.

How much is final expense insurance for seniors?

Final expense insurance for seniors is actually inexpensive relative to the maximum coverage you can qualify for.

Below is a sample table demonstrating some introductory price points one may expect when applying for final expense insurance for seniors.

Keep in mind that these are just estimates and do not reflect the actual price you may receive after qualification. If you have any questions, we recommend you contact your preferred agent.

If you don’t have a preferred agent, we’d recommend Final Expense Benefits.

|

Age

|

Coverage Amount

|

Monthly Premium

|

|---|---|---|

|

50

|

$20,000

|

$44-$59

|

|

60

|

$20,000

|

$61-$97

|

|

70

|

$20,000

|

$102-$183

|

|

80

|

$20,000

|

$193-$547

|

These figures were obtained from the NFDA and are estimates only. For a detailed quote, please contact an agent.

3. Fixed Rate Upon Approval

Final Expense Insurance for seniors as a policy contains a stipulation in that your rate is locked in upon approval, meaning your monthly premium will never increase so long as you continue to maintain said premium in a timely manner.

It’s important to keep in mind that although the rate you were given upon acceptance is locked in, the cost of a funeral is not and can change at any time.

4. No Medical Exam

Final expense insurance for seniors will never require a medical exam for qualifications, rather a medical questionnaire may be utilized to assess your overall status.

Some policies contain absolutely no underwriting at all.

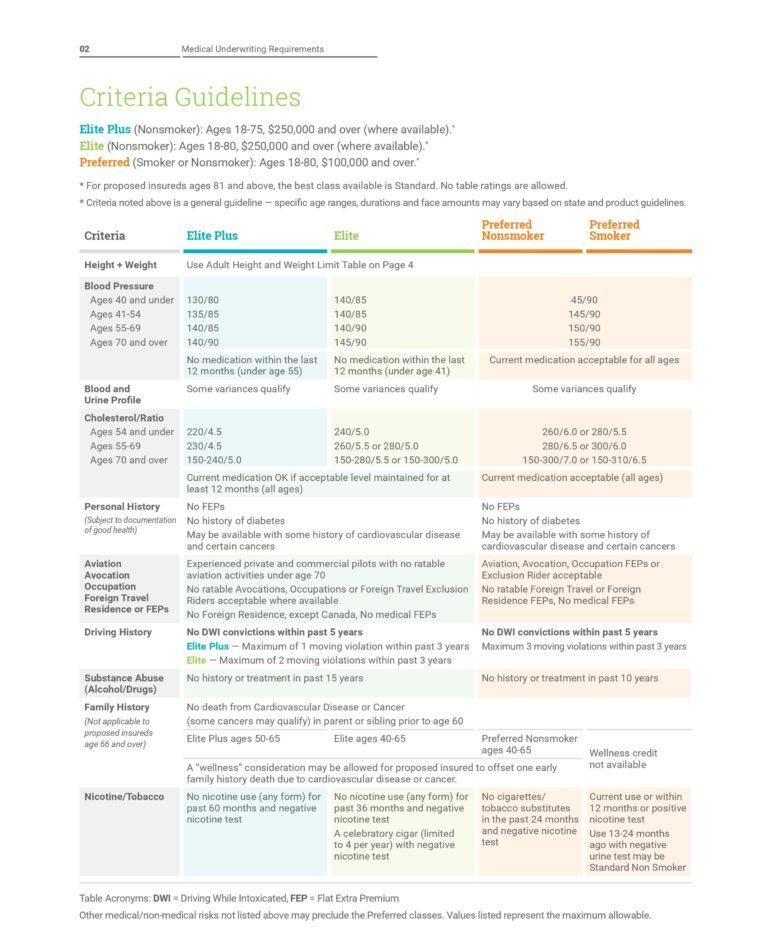

It’s important to consider what underwriting a specific provider may request of you, as well as what questions you can expect to see on a questionnaire.

What Questions Can I Expect On a Medical Questionnaire?

Underwriting changes depending on the provider, as different companies put emphasis on different aspects of health.

Some of the most important questions to expect on a medical questionnaire include:

Tobacco Use

Underwriting changes depending on the provider, as different companies put emphasis on different aspects of health.

Some of the most important questions to expect on a medical questionnaire include:

Pre-existing conditions

The existence of pre-existing conditions can also directly affect your risk and therefore your monthly premium.

Family History

The presence of conditions in your family may directly correlate to your relative risk factor when deciding your applicant status.

5. The Payout Can Be Used For Anything

Although a final expense policy is meant to mitigate funeral costs and final expenses, the payout amount may actually be used at the discretion of the beneficiary.

The beauty of this is rooted in the freedom this policy provides beneficiaries.

Say, for example, your term policy pays out to beneficiaries, and they have more than they need to cover final expenses and then some.

Your additional final expense insurance for seniors policy now acts as supplemental assistance to those left behind, further solidifying your legacy and creating a lasting image of greatness for those that care about you.

Cons of Final Expense Insurance For Seniors

Overall smaller coverage amount then other policies

Although your relative monthly premium will be lower than those with a larger maximum policy, your overall payout will be less as a result.

Most of the time, final expense insurance for seniors isn’t the sole policy one may own as the maximums are much less than a term policy for example.

Both may be utilized at the same time, though, to further provide safety and comfort to beneficiaries.

You must choose your beneficiary wisely.

As final expense insurance for seniors only pays out if you pass away, it’s important to make sure you are able to trust the person listed as your beneficiary.

You obviously will not be there to make sure final expenses and any outstanding debts are taken care of appropriately.

Funeral costs are on the rise.

It’s no surprise that funeral costs are rising, as are most other things in America with the constant barrages of inflation and economic hardship.

Even though your rate is locked in for life with a Final Expense Policy, the cost of a funeral however is not.

It’s unlikely that funerals will pass the $50,000 mark anytime soon, but we truly never know.

What Can I Expect When Applying for final expense insurance for seniors?

A Quote.

Either Online or via a cost free consultation phone call.

Most insurance providers and brokerage firms offer you the ability to receive a cost free quote online via a quoting tool or something similar.

It’s in your best interest to utilize the services provided by these independent agencies as they do the heavy lifting for you.

It would be a tremendously tedious task to acquire a quote from 10+ insurance providers yourself.

An independent agency would also be able to effectively assess which policy type works best for you, as that is what they are paid to do.

Medical Underwriting.

Medical underwriting, or specifically how an insurance provider assesses the general risk you pose to the company if they were to insure you.

The higher the implied risk, the higher your relative monthly premium (to maximum coverage amount).

It’s also important to note that not all final expense policies have medical underwriting, whereas some contain guaranteed acceptance.

Those that have guaranteed acceptance fall under guaranteed issue, whereas those that contain medical underwriting and a chance at disqualification fall under simplified issue.

Phone Interview.

This only occurs in the case of medical underwriting, so if your policy doesn’t have underwriting, you needn’t worry about this step.

If your policy happens to fall under a simplified issue, then it’s common to expect a followup phone call proceeding you filling out the underwriting.

This phone call’s purpose is simply to confirm and assess that the information provided is correct to the best of your knowledge.

Well, Where Do I Begin?

If you’re unsure where to find the right licensed agent for you,

We encourage you to consider Final Expense Benefits.

We at Final Expense Benefits partner with over 20 carriers, with:

Being some of the ones that stand out among the crowd.

Reduce the stress involved with life insurance and let us do all of the heavy lifting for you.

You can reach us at 1 (866) 311-4338, and we’re open from 9-5, Monday through Friday.

Final thoughts

There’s really only a few reasons to avoid a Final Expense Policy, as most of the time this policy only serves to better the lives of your beneficiary in your absence.

Because a final expense policy is relatively cheap and easy to qualify for, this alleviates the stress associated when applying for a traditional life insurance policy, as this is usually much more rigorous.

In some cases, you’re also able to receive a policy at an incredibly young age, sometimes as low as 18.

final expense insurance for seniors also may coexist with a plethora of other supplemental programs, doubling down on the safety of you and your family’s future.