A Comprehensive Guide to Burial Insurance With No Waiting Period: How It Works For Your Family

Updated on Jan 17, 2025 • 4 min read

You can never know when you’ll pass away, but you can be prepared. Help your family prepare for a potential funeral bill with burial insurance. Learn how you can get your beneficiaries cash from your burial insurance policy without waiting, helping them cover big up-front expenses with confidence.

Check below to read more about burial insurance with no waiting period and proceed with confidence. Call us at (866) 786-0725 Monday through Friday, 9 a.m. to 5 p.m., if you want to check if you’re eligible for one of these policies or take a look at our free online quoting tool for some possible rates.

If you’re interested in these or any of our other life insurance options, call us at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

What is Burial Insurance With No Waiting Period And How Does it Work?

Also known as final expense insurance, burial insurance is a special type of whole life insurance that often provides a smaller, tax-free payout intended to help cover funeral expenses. Burial insurance policies are typically designed with senior applicants in mind, with relaxed applicant requirements.

Typically, life insurance policies won’t pay their full death benefit if the policyholder dies within two years of policy approval. A policy for burial insurance with no waiting period eliminates that two-year delay. And that’ll prepare your family for a big expense when funeral bills arrive.

Life Insurance Definitions

Life insurance provides a death benefit, which is the money paid to the policy’s beneficiary upon the insured person’s death. Beneficiaries are the payout recipients designated by the policyholder. The death benefit’s value is agreed upon by the provider and policyholder at the policy’s start and is usually paid as one large lump sum.

Plans with higher death benefits will typically cost more per month. The monthly payment is called the premium.

Life insurance comes in three major forms: final expense insurance (also known as burial insurance), term life insurance, and whole life insurance. Each type’s purpose and intended market are different.

How To Qualify For Burial Insurance With No Waiting Period

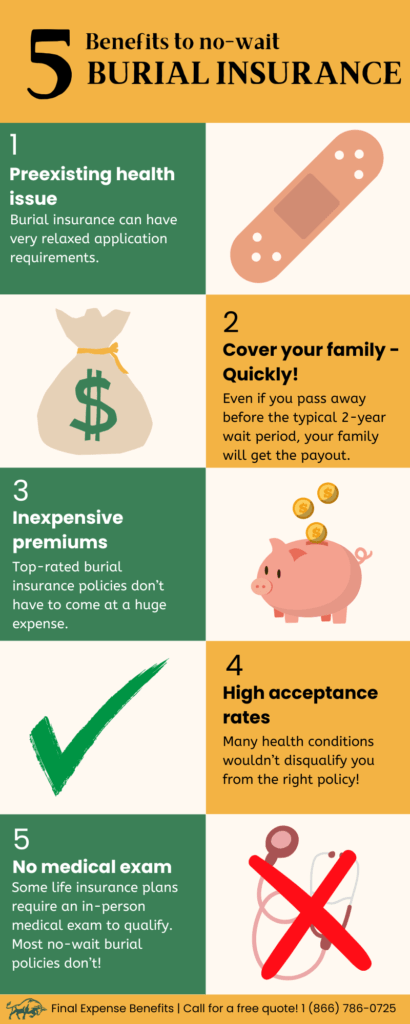

Typically, insurers will assign either a medical questionnaire or an in-person exam with a medical professional to assess risks from policy applicants. Most burial insurance policies will not involve an exam, as they are designed with seniors who may have preexisting health conditions in mind.

You will likely need to fill out a medical questionnaire, but it doesn’t have to be scary. In fact, you can apply with confidence, because very few health conditions will disqualify you for a burial insurance plan.

You can even apply for a burial insurance plan with guaranteed acceptance, but these plans differ greatly from other burial insurance policies.

Can You Get Guaranteed Acceptance Burial Insurance With No Waiting Period?

A guaranteed acceptance plan is great for those with preexisting major health issues to provide a burial insurance payout. Unfortunately, any guaranteed acceptance burial insurance policy will have a mandatory two-year waiting period and typically provide a smaller death benefit payout than a normal plan. No insurers offer a guaranteed acceptance plan without a waiting period, and it’s unlikely that they ever will, but don’t worry.

Even with a fairly major preexisting medical condition, you can still find good burial insurance with no waiting period. That’s why it’s important to find good help; for example, our agents at Final Expense Benefits are experts at finding the right insurance policy for each client’s needs.

What Is Partial-Wait Burial Insurance?

Also known as a graded death benefit plan, a partial-wait burial insurance policy portions out your death benefit payout to beneficiaries before the end of the two-year waiting period. So with a graded plan, if you pass before the two-year period ends, your beneficiaries will receive a portion of the benefit.

Typically, these plans will pay out over a yearly schedule, but payouts depend on the insurance provider. The average plan will pay up to 40% of the death benefit during the first year after the policy purchase, up to 70% in the second year, and the remainder once the second year ends.

Since they involve a higher level of risk to the insurer, graded death benefit plans often charge a higher monthly premium and usually require the completion of a medical questionnaire.

How Much Does A Funeral Cost?

It’s a good idea to set aside some money to potentially cover your funeral. Funeral costs are rising across the United States, with the median price for a funeral with a service reaching $8,300, per the National Funeral Directors Association.

This rate is for funerals with only basic services and a simple casket; it doesn’t include cemetery costs. With common extra expenses tacked on, funeral prices could easily exceed $10,000 – that’s why burial insurance policies are typically quoted at a $10,000 benefit.

What Are The Benefits of No-Wait Burial Insurance?

Aside from the obvious benefit to those with major health issues, no-wait burial insurance has a few distinct advantages.

Chief among these is the high acceptance rates. You’ll be surprised to see how many major health conditions may not disqualify you from a burial insurance plan without a waiting period.

Another major benefit to burial insurance, even policies with no waiting period, is that you’d probably be paying a low premium rate. Some of our recommended burial insurance policies charge a monthly premium that could even be below $40 per month, even with a preexisting condition. Here are some sample monthly rates from our recommended no-wait burial insurance policies:

- Mutual of Omaha: $34.51 monthly premium

- AIG: $37.65 monthly premium

- Prosperity Life Group: $37.65 monthly premium

These premium rates were calculated at $10,000 in coverage for a 61-year-old woman with diabetes.

Health Conditions That Could Disqualify You From No-Wait Burial Insurance

While many burial insurance with no waiting period providers do factor in more flexibility than they would for less specific insurance policies, some health conditions will almost always make you ineligible for a no-wait plan. These conditions include (but are not limited to):

- AIDS/HIV

- Alzheimer’s

- Cancer within the last 12 months

- Dialysis

- Stroke/Heart attack within the last 12 months

- Obesity

Each provider has different acceptance criteria, and our expert insurance brokers can find plans that fit your unique health concerns.

Conclusion

Burial insurance with no waiting period can help your loved ones get the payout they need without delay. This can be a great way to avoid unnecessary delays when major up-front costs like funeral bills loom.

Find the policy that works for your specific health needs with help from Final Expense Benefits. Give us a call at (866) 786-0725 Monday through Friday, 9 a.m. to 5 p.m., or have a look at our free quoting tool to start down the path to peace of mind.

Frequently Asked Questions

What Are The Differences Between Final Expense Insurance and Burial Insurance

Can You Get Burial Insurance Without A Waiting Period?

Yes; while the wait for burial insurance is typically up to two years, even those with some fairly major health concerns can be eligible for a plan with no waiting period.

How Do I Get A Guaranteed Acceptance Burial Insurance Policy That Has No Waiting Period?

How Long Will It Take For Burial Insurance With No Waiting Period To Pay For A Funeral?

Typically, providers will pay out benefits between 14 and 60 days after the claim is submitted.