Funeral Cost Calculator

Get a clear breakdown of funeral expenses based on your choices. Compare options and make informed decisions to ease the financial burden on your loved ones

Estimated expense

Based on the details you’ve provided, here’s an estimate of your funeral expenses.

Start by selecting your funeral preferences.

Estimated total

$0

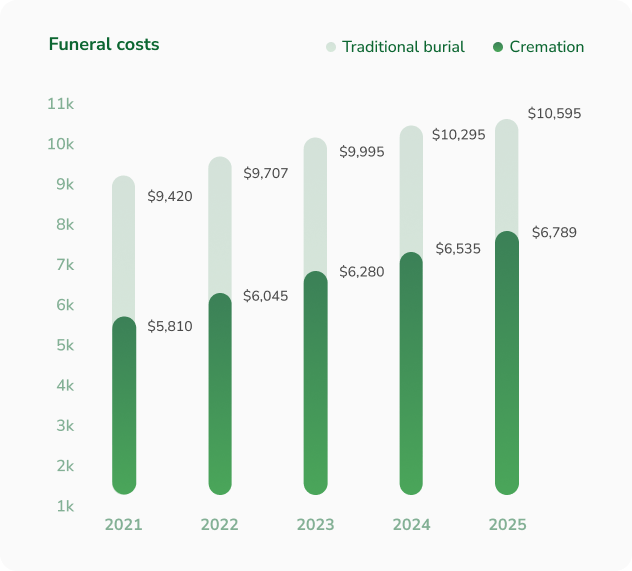

Rising Funeral Costs Over the Years

Funeral expenses continue to rise due to inflation and increasing service costs. See how prices have changed over the years and plan ahead to secure lower rates.

According to the National Funeral Directors Association (NFDA), a traditional burial is estimated cost of a funeral is estimated to increase by 6.1% while a traditional cremation will increase by 8.1%.

Our funeral costs calculator reflects this estimation based on your region and the changes that we expect to see in the market. However, you should always check with an insurance agent to find out exactly how much a funeral will cost in your region.

Luckily, our insurance experts can determine your funeral costs and find the exact coverage you need to fully fund your expenses.

Call us at (833) 759-3578 or use our quoting tool to get started on your journey to financial peace of mind.