When To Get Modified Life Insurance | Uses, Benefits, & More

Updated on Jan 21, 2025 • 5 min read

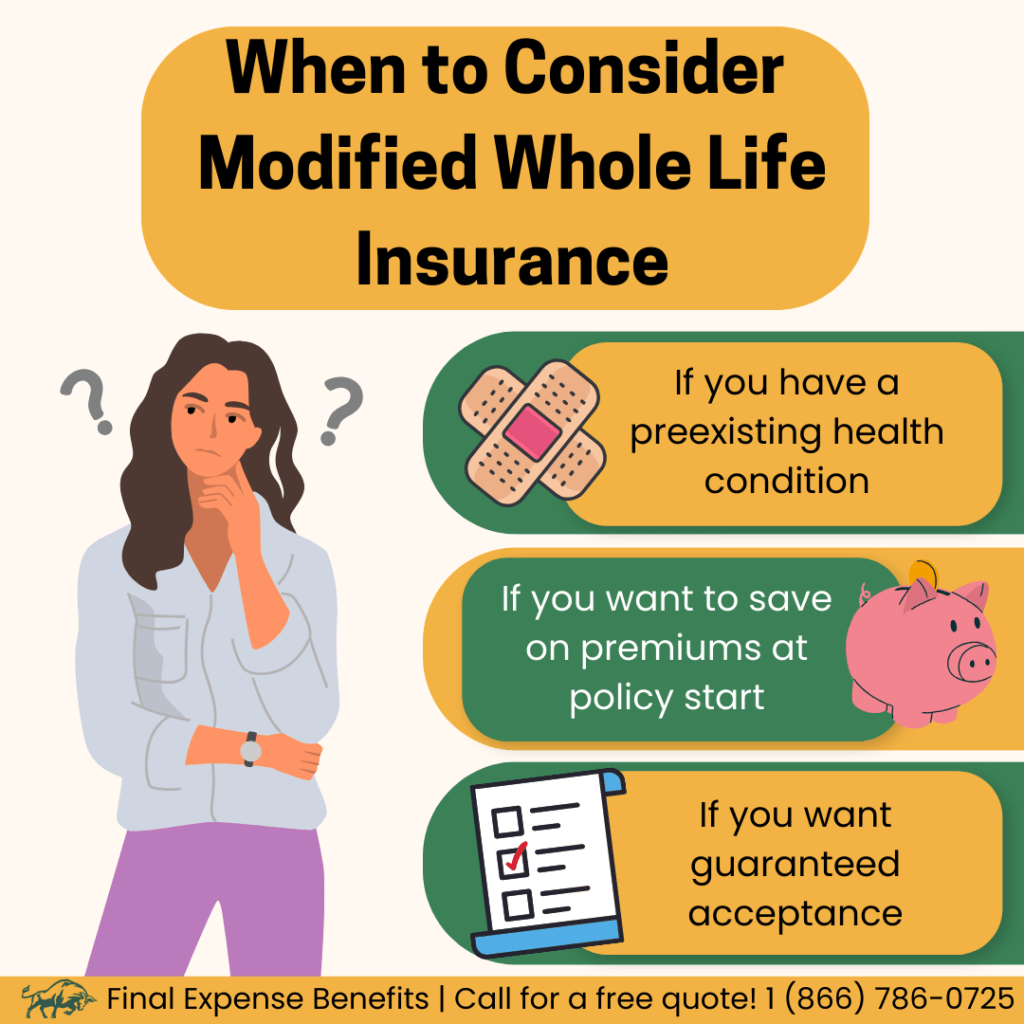

If you have a major preexisting health condition, navigating the confusing life insurance market can be a daunting task. Modified whole life insurance could be a good option if you’re having trouble qualifying for traditional policies, as many policies are designed with those with serious medical issues in mind.

Modified life insurance can be a tricky topic. How the premiums and the benefits work can be tough to understand; that’s why we have an expert team of life insurance brokers at Final Expense Benefits. Call us at (866) 786-0725 Monday through Friday, 9 a.m. to 5 p.m., to learn more about modified whole life insurance and your other options if you have a major health issue. You can also look at our free online quoting tool for estimates.

If you’re interested in life insurance, call Final Expense Benefits at (866) 786-0725 to learn more. Be sure to check our free online quoting tool for personalized pricing estimates.

What Is Modified Whole Life Insurance?

Modified life insurance is a type of whole life insurance in which you pay a lowered premium for the first few years of the policy and after a set period, the premium rate increases. The rate increase timing varies from 3 to 10 years, depending on the insurance provider.

Modified whole life insurance will always have a waiting period. If the policyholder dies within that time, the beneficiaries will not be paid the full policy benefit. The waiting period will typically be about 2 to 3 years after policy approval.

While modified life insurance will always have a waiting period, many insurance types do not. No-wait whole life insurance policies are very popular, but modified life insurance still has distinct benefits.

What Does Life Insurance Cover?

A major advantage of modified life insurance is its relaxed application requirements. Most people, even those with major health complications, can be approved for a policy. Having almost guaranteed approval can benefit those with preexisting conditions.

Modified life insurance will typically have limited underwriting, which means that a provider will approve many applicants who carry extensive risk for the company, such as those with preexisting health issues. Each insurance provider has its requirements, so it’s important to speak with an agent who knows each provider’s unique acceptance procedures.

Modified life insurance can also be a great choice if you have little flexible cash at the beginning of the policy, but expect to have more in a few years to cover the rate increase.

What Are The Disadvantages of Modified Whole Life Insurance?

While the initial lower premium rates can be tempting, modified life insurance could be more expensive over a longer term than a comparable whole life policy. This is why modified life insurance is typically only recommended to those with major preexisting health concerns that disqualify them from other plans.

In addition, the waiting period can be up to 10 years on some carriers. Our agents can help guide you from a policy with a long waiting period, but keep in mind that it may not be possible to do so, depending on your circumstances or provider requirements.

Many no-wait life insurance policies have relaxed application requirements. You may be surprised by the number of health conditions that won’t affect eligibility for a policy without a wait, but some medical issues will still disqualify you from no-wait policies.

Modified life insurance or a similar guaranteed-acceptance policy could be the only option if you have any of these health concerns:

- Organ or bone marrow transplants

- Dementia or Alzheimer’s

- Currently have or are being treated for cancer

- AIDS or HIV

- Liver failure

- Are currently in a nursing home, hospital, or nursing facility

- Are wheelchair-bound due to disease or illness

What is Modified Benefit Life Insurance?

Modified benefit life insurance sounds similar to modified whole life insurance, but they aren’t the same. In a modified benefit whole life insurance policy, the benefit’s value increases over time because the cash value accumulated on the policy is added to the death benefit, instead of being cashed out by the policyholder.

Modified death benefits are commonly known as increasing or rising benefits.

Modified Life Insurance vs. Convertible Life Insurance

Convertible life insurance is a type of term life insurance that offers the option to convert your policy into a whole life policy once the term ends. Convertible life insurance tends to have a less expensive premium rate than modified life insurance and has largely replaced it as a popular insurance type.

Modified whole life insurance does have advantages over convertible life insurance. First, it is a whole life insurance plan, so it accumulates cash value over time, though not until the premium rate increases. Second, convertible life insurance can be more difficult to qualify for than a comparable modified policy, due to it being a term policy.

Conclusion

Modified whole life insurance has become less popular over the years, but still has its uses. Those with major health concerns may have no option other than a modified plan. This is why it’s important to plan ahead and have a trusted broker.

Final Expense Benefits can help you find a plan that fits your needs. Contact us with any life insurance questions at (866) 786-0725 Monday through Friday, 9 a.m. to 5 p.m., and we can help you determine if modified life insurance is a good choice. Be sure to use our free online quoting tool to find some sample rates to expect for your unique circumstances.

FAQ

Can you get modified life insurance with no waiting period?

No; because modified life insurance typically has a very high approval rate, it will always have a waiting period of at least 2 to 3 years.

How long does it take for modified life insurance to gain cash value?

On most carriers, it takes until the premium increase goes into effect. The rate increase will typically start between 3 and 10 years after policy approval.

Can you get a life insurance policy with guaranteed approval?

Yes! Modified life insurance is a good option if you need a policy that guarantees approval. However, many no-wait policies have relaxed approval requirements and may be a better option.