What Is An Annuity? | How Annuities & Life Insurance Can Form A Comprehensive Retirement Plan

Updated on Mar 20, 2025 • 7 min read

Annuities and life insurance can both serve as financial pillars for retirees. In fact, a life insurance policy and an annuity have a lot in common. Annuities and life insurance are offered by insurance companies and both provide stable income after retirement.

Additionally, they’re both a great way for you to turn assets earned during your career into stable cash payouts in the future. They differ in the payout structure, as annuities pay during the holder’s lifetime and life insurance pays after, but they each can form a key part of financial health during retirement and beyond.

If you’re interested in learning more about life insurance and annuities, contact Final Expense Benefits. Our licensed life insurance specialists will be happy to help you understand your life insurance options and help you create a plan.

Call us at (866) 786-0725 Monday through Friday, 9 a.m. to 5 p.m. ET to learn more. Check our free online quoting tool for life insurance estimates.

What Is An Annuity?

An annuity is a financial product that provides guaranteed income. It’s similar to a term life or whole life insurance policy, involving an up-front payment period and a payout to a beneficiary. However, unlike life insurance, annuities usually pay out to the policyholder or investor, also known as the annuitant.

Annuities and life insurance both serve as backup income, but for most annuities, deposited payments are pre-tax and illiquid. This means that you can’t access your annuity’s cash value without taxes or fees taking some of that cash away.

A lack of flexibility is one of their primary drawbacks — annuity tax implications can be quite complex and cash can be difficult to access. These are the main reasons why annuities aren’t typically recommended for younger investors or those who need access to cash.

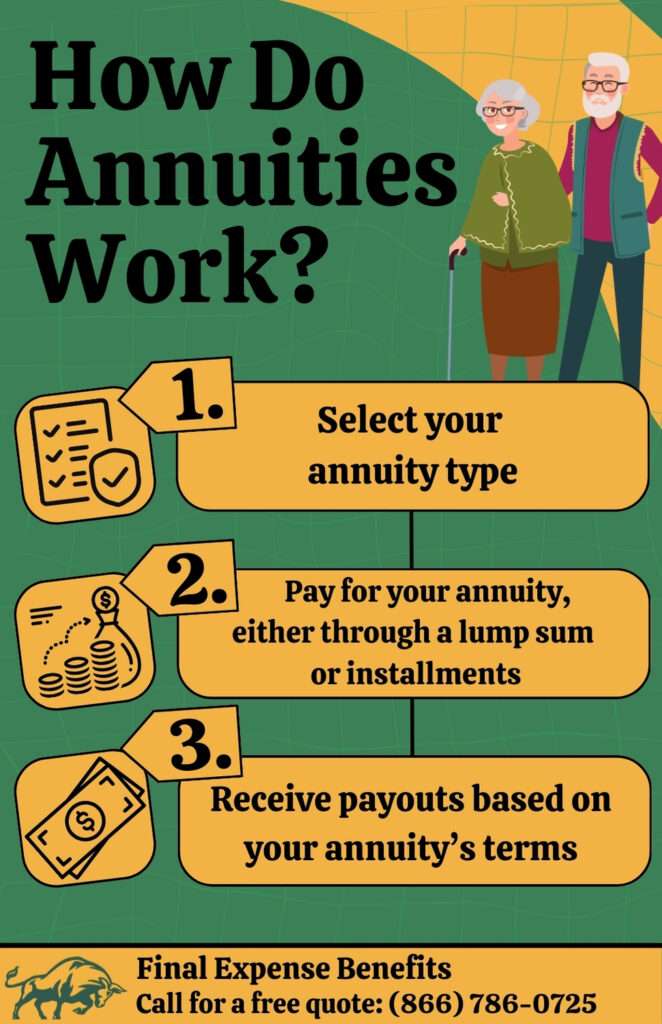

How Do Annuities Work?

Unlike life insurance and especially final expense insurance, which are straightforward and generally involve simple pay-in and payout periods, annuities come in several forms and could involve a complex payout period.

Though annuities are more complicated than life insurance, they generally involve a pay-in period where the annuitant adds funds, and a payout period, where they are paid a stable amount, usually monthly. Below is a breakdown of major annuity components:

Immediate & Deferred Annuities

Most annuities are separated into two main types: immediate annuities and deferred annuities. Immediate annuities involve a single, lump-sum payment followed immediately by the payout period.

The payment period in a deferred annuity is significantly longer. In a deferred annuity, the annuitant pays over an extended period, building up the annuity’s cash value much slower than an immediate account. The annuity is paid following the buy-in period.

Annuity Phases

Annuities are generally divided into the buy-in, or annuitization, phase and the payout phase. Payments in the annuitization phase can either be in a single lump sum or smaller amounts spread over a longer time.

The payout period immediately follows the annuitization phase. The payout amounts and duration are set when opening the annuity account. Generally, annuities are paid to the annuitant.

However, annuity providers offer survivorship riders that can also authorize payouts to a spouse or other designated beneficiaries. Annuity riders are just like life insurance riders, with optional extra coverage that may come at a higher cost.

Annuity Surrender Period

Similar to a waiting period on a modified life insurance policy, most annuities have a surrender period in which the annuitant can’t withdraw from the account without a fee. Many annuity surrender periods are two years, though this may vary by the annuity provider.

Annuity providers often allow annuitants to withdraw up to 10% of their annuity’s value without a fee, but this can vary by provider.

Contact Final Expense Benefits to learn more about life insurance and to develop your retirement income plan. Call us at (866) 786-0725 for more information and be sure to check our free online quoting tool for life insurance estimates.

Types of Annuities

In addition to varying annuitization phases, annuities often vary in how their cash value grows. This generally affects how payouts are handled.

Fixed Annuities

The simplest and most reliable annuity type, fixed annuities grow at a guaranteed minimum interest rate. Fixed annuities offer the lowest returns on our annuitized funds. However, you generally won’t lose value due to unfavorable market conditions with a fixed annuity.

Variable Annuities

Variable annuities take the annuitized cash and invest it in the stock market. They can offer the best returns out of all annuities, but also are the most volatile. A variable annuity could lead to the annuitant losing money in an unfavorable market.

Indexed Annuities

Like a variable annuity, value in indexed annuities is tied to the market. However, an indexed annuity is tied to the performance of equity indexes like the S&P 500. Therefore, indexed annuities can offer significant upside, but don’t have the same volatility as other variable indexes.

Annuity Riders

Many providers offer optional extra annuity coverage called riders. They operate similarly to life insurance riders and often come at an additional cost.

Riders can often be used to manage risk on variable and indexed annuities, protecting you from losing cash in an unfavorable stock market. Another common rider is the death benefit rider. This makes an annuity pay out to designated beneficiaries after the annuitant’s death, similar to a life insurance policy. Some annuities include a rider that accelerates payments if the annuitant is diagnosed with a terminal illness.

Non-Qualified Annuities

Most annuities are qualified, which means the annuitant pays into them with pre-tax dollars. Non-qualified annuities are purchased with after-tax dollars. Some non-qualified annuities may involve different tax and surrender implications than qualified plans, so it’s important to review your options thoroughly.

Annuity vs. 401k

Employer-sponsored 401(k) investment accounts are one of the most popular ways to save for retirement. They can be an effective way to set aside income for retirement, but 401k accounts have several limitations compared to annuities.

For one, annuities offer near-guaranteed returns and have little risk of market loss. 401k accounts are tied to investments and therefore carry significant market risk. Earnings in a 401k can be wiped out with poor market performance, whereas even the most unstable annuities are largely protected from market concerns.

While an annuity’s market risk is often much less than that of a 401k, returns can be nearly as significant. According to Nerdwallet, the average annual 401k return is 9.7% but can be quite volatile. Annuity returns, per CNBC, often average around 4% to 6% annually, with some risk of loss.

However, annuities do offer some limited accessible liquid cash, while 401k cash value is inaccessible without significant taxes and fees. However, because 401k accounts are such a popular choice, many employers offer employee contribution matching. This is a great way to save additional funds you may otherwise miss.

401k investment accounts and annuities offer significant upside and serve different roles in a thorough retirement plan. However, if your goal is flexibility, an annuity may be a better choice.

Overall, a 401k is better for younger workers aiming to save over time and watch their investments grow exponentially. Working individuals are better equipped to deal with market loss than many seniors. Conversely, annuities are best suited for seniors who have already earned their assets and want to use them for retirement income.

Annuities vs. Life Insurance

Overall, annuities and life insurance are quite similar, differing mainly in how benefits are paid. Annuities pay during the annuitant’s lifetime and are ideal for providing retirement income. Life insurance funds are only paid after the policyholder’s death and are often used to cover end-of-life expenses like medical care and funerals. They both involve a pay-in period and allow for cash value growth over time, but unlike some annuities, life insurance payouts are tax-free.

While it might seem that annuities and life insurance are somewhat at odds, they each serve an important, distinct role in senior financial preparedness. They can work together to provide seniors with a strong financial plan in retirement and beyond.

Both annuities and life insurance are great ways to turn current assets into future cash. Annuities are often used by lottery winners or others with large cash lump sums to turn a lump sum into future income. Turning current assets into future ones is a great way to pave a strong financial path ahead and protect them from taxes or penalties.

Using life insurance and annuities together is a great way to address your finances during retirement and make sure loved ones are covered after your passing. There’s a reason why top-rated life insurance providers like Mutual of Omaha also offer annuities!

Final Thoughts

Annuities are an effective way to ensure you have financial security during your retirement years. They can often have complex tax implications and fees that you should carefully consider, so it’s important to have strong support and a strong understanding before you select an annuity.

Annuities can make a thorough plan for income through retirement and beyond, ensuring coverage for loved ones well into the future. It’s always a smart financial plan to turn current assets into future income, and life insurance and annuities can work together to help your future financial outlook.

Contact Final Expense Benefits to learn more about life insurance and to develop your retirement income plan. Call us at (866) 786-0725 for more information and be sure to check our free online quoting tool for life insurance estimates.

FAQ

What is an annuity?

An annuity is a financial contract between an insurer and an individual in which the purchaser pays funds that are later turned into fixed, scheduled payouts.

What is a fixed indexed annuity (FIA)?

A fixed indexed annuity (FIA) takes value from the performance of an investment index like the S&P 500. It’s different from a normal indexed annuity because it has protection against value loss.

What is a registered index-linked annuity (RILA)?

A registered index-linked annuity is an annuity that has mostly fixed growth, with some exposure to a stock market index like the S&P 500 that allows it to grow in value. They typically provide more market protection than other variable annuities.

What is an annuity surrender period?

An annuity surrender period is the time in which an annuity holder cannot withdraw funds from the annuity’s cash value without being charged a fee. Some annuity providers allow holders to withdraw up to 10% of the annuity’s value without a fee.

What is a 1035 exchange?

A 1035 exchange is an Internal Revenue Service (IRS) provision that allows a tax free-transfer of an existing annuity or life insurance policy. 1035 exchanges are usually used to sell life insurance policies and annuities for cash or other considerations.